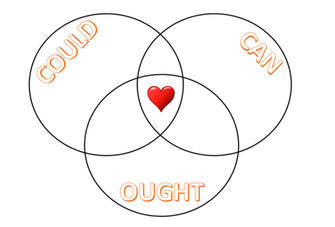

Jim Kasch Jim Kasch by Jim Kasch, Canidae Consulting Perhaps no aspect of business has been written about more than leadership. I’ve certainly done my share of reading on the subject, and over time have developed my own opinions. While leadership stretches far beyond the business world, this article takes a look at leadership inside the credit union universe that I’d like to focus on. As my clients would tell you, I am a proponent of the three-headed leadership team. There are obvious benefits to having three at the top of the org chart, three voices, three brains, three sets of experiences. There is one, usually the CEO, where the buck ultimately stops. But in thinking strategically, building and executing plans, supporting the organization, and countless other ways, three is the magic number. (I’ll give bonus points to anyone who immediately thought of Brother Maynard reading the instructions for the Holy Hand Grenade! “Thou shalt not count to two unless thou immediately counts to three. Five is right out!”) There are also three imperatives to consider when thinking strategically about your credit union. It’s best if each of your three top executives fill one of these roles, and it doesn’t matter who fills which. These are the three questions you must ask yourself and why each is important: 1. What COULD we do? What could we do is the most expansive question. Every alternative is equal, and every potential strategy is worth considering. There are no limits to COULD. 2. What CAN we do? It’s here where reality sets in. Considering all of the multitudes of options available that we COULD do, what are we actually capable of accomplishing? What CAN we do, based on our resources and circumstances? This is not to say we can’t generate more resources or alter our circumstances, but right now, these are the viable options. 3. What OUGHT we do? What ought we do is the soul of the organization. It checks every option against our core values and runs them through the filter of our essence. Maybe we need loan growth, and we could offer stated income mortgages, and our system and team can handle them. But it's never what we ought to do. As CEO at Darden Employees FCU, I filled the role of COULD, constantly thinking of new strategies and tactics to get where we needed to go.

My COO, Justin Curcio, filled the role of CAN, constantly reminding me of what was actually possible. He savored commending me on a great idea then immediately asking me which of yesterday’s great ideas I wanted him to stand down on. Our CFO, Tonya Voltolina, filled the OUGHT role. She kept us grounded and true to our core values, reminding us about the impact some ideas would have on our members, on the sponsor, or on our team. Who fills each of those roles within your credit union? Jim Kasch is a 25-year credit union industry veteran who has held senior level positions at Partner Federal Credit Union, serving The Walt Disney Company, as well as CEO of Darden Employees Federal Credit Union. He is now the principal at Canidae Consulting, which provides strategic guidance to credit unions; Member Intelligence Group, which provides member engagement surveys for credit unions. Jim’s companies’ services are offered to our credit unions through a partnership with the League. Meet Jim and Tonya Voltolina, founder and CEO of Eleven Performance Group, at their booth or during their presentations at DakCU’s Annual Summit. Tomorrow, April 21, is the FINAL DAY to register! Comments are closed.

|

The MemoThe Memo is DakCU's newsletter that keeps Want the Memo delivered straight to your inbox?

Archives

July 2024

Categories

All

|

|

Copyright Dakota Credit Union Association. All Rights Reserved.

2005 N Kavaney Dr - Suite 201 | Bismarck, North Dakota 58501 Phone: 800-279-6328 | [email protected] | sitemap | privacy policy |