|

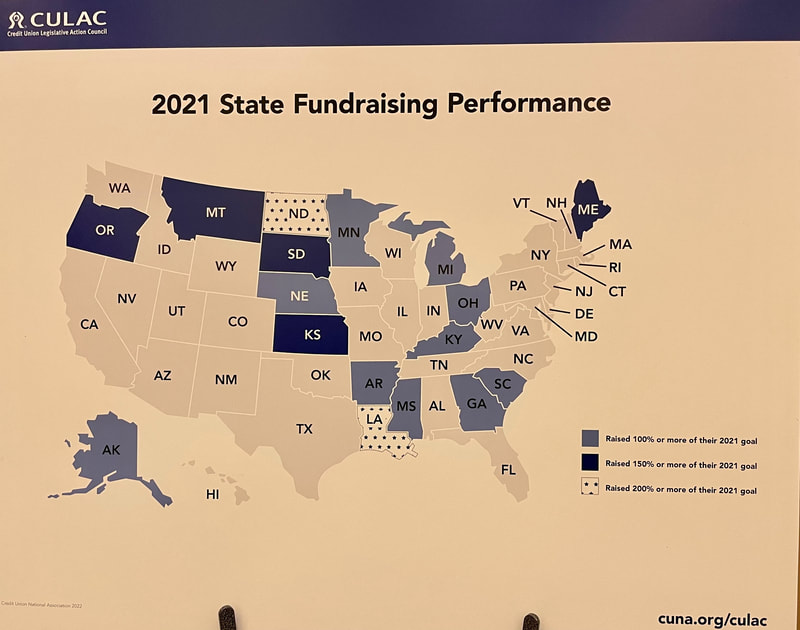

Photo above: Jeff Olson in the "GAC Studio" for a wrap-up session with Brad Miller, AACUL President. Greetings and Happy Monday! It had been 735 days since credit unions from across the country had the chance to meet in person, but last week, nearly 4,000 CU professionals and advocates were back in Washington, D.C. for the return of the CUNA Governmental Affairs Conference. In my professional career, I have had the opportunity to participate in many conferences and trade association events over the years; I have had the privilege to be an advocate in some form or fashion for the past 25 years, and have traveled to Washington, D.C. more than 50 times. The CUNA GAC event is clearly my favorite, and it seems like the bar keeps getting higher each year. As the current chair for the American Association of Credit Union Leagues (AACUL), it was an extremely busy week for me personally, as I had 18 meetings or events that took place before the opening ceremonies and before the first speaker even hit the stage! Even though our overall participation numbers were down this year, I want to give a huge shout out to our 29 Dakota advocates that traveled to participate. Your engagement and leadership is important as we advocate for our movement, improve the financial lives of our members, and continue to advance the communities we serve. As I summarize the past week’s events, it is clear that the 2022 GAC was great, especially for our Dakota credit unions! Here are some of the highlights: Floyd Rummel, President/CEO, Northern Hills FCU, Sturgis, SD was inducted into the CU House “Hall of Leaders” during the 20th Anniversary celebration of Credit Union House. During the CULAC Annual Meeting, North Dakota credit unions were recognized with the Vanguard Award for the second year in a row for achieving the highest percentage over goal for CULAC fundraising. South Dakota credit unions were also recognized with the 3rd Place honor. Chad Moller from Dakotaland FCU (Huron, SD) and Paul Brucker from Railway CU (Mandan, ND) were both honored with CULAC Ambassador status for their ongoing leadership in political fundraising. Multiple Dakota CU leaders represented our League by participating and serving on National Committees: Pat Tollefson (Area FCU) serves on the Volunteer Committee; Melanie Stillwell (Western Cooperative CU) serves on the Supervisory and Examination Committee; Jerry Schmidt (Black Hills FCU) serves on the CU Powers Sub Committee; and Jeremiah Kossen (Town & Country CU) and Amy Kleinschmit (DakCU) both serve on the Consumer Protection Subcommittee. Our Dakota GAC Crashers, Andy Kronaizl (Vermillion FCU) and Chelsea Gleich (Town & Country CU) were very engaged throughout the week and made us proud as they carried our state flags during the opening ceremonies. And, of course, Roger Heacock, retired CEO from Black Hills Federal was honored with the Herb Wegner Lifetime Achievement award during the National Credit Union Foundation’s recognition banquet. I may be biased, but Roger’s recognition video was one of the best I have ever seen presented at the Wegner Awards. If you haven’t seen it, I encourage you to take a few minutes to watch the extraordinary accomplishments of Roger’s inspiring career. You can find the video here. For me, it was a privilege and a career highlight to join my peers (league executives from across the country representing each state through one of our 35 Leagues/Associations) and provide the state of the credit union/league system update during the CUNA Annual Meeting on the “big stage.” Here are just a few of the accomplishments of the league partners over the past year:

Looking ahead, Leagues are closely working with our partners at CUNA in reviewing and taking a deep dive into what our future advocacy needs may look like, Including reviewing our current state of credit union advocacy. Recommendations on how CUNA and Leagues can best create and execute our advocacy strategy and agenda in the future are coming soon. Marvel’s story makes it to the GAC “big stage.” While on stage, I took a moment to tell Marvel’s story. This is a story that many of you already know – but for those who are not familiar with her journey, Marvel Ebenhan was the longtime CEO at Community Credit Union in New Rockford, ND. She held that role for more than 65 years – serving her members and helping her rural communities get through some pretty tough economic times throughout her career. Marvel’s simple theory was, “If we (credit unions) can’t be different, why are we doing this?” (By chance, this is very similar to Jim Nussle’s opening speech.) In my opinion, Marvel’s story is unique, and it deserved to be shared on the big stage. Summit Crasher opportunity. Now we turn our attention to our next big event! In the interest of engaging more credit union young professionals, our Annual Summit will again feature an incredible Crasher opportunity for those age 35 or under. Not only will Crashers have the opportunity to take in top industry speakers, they will also gain valuable insight about the credit union movement, expand knowledge, and enhance their professional development and network. I strongly encourage you to consider having one (or more) of your emerging leaders apply for one of these spots. Each Crasher will receive free conference registration, not to mention a glimpse into the larger credit union world! Click here for more information and the application survey. $ave with Summit Early Bird Registration. Speaking of the Summit – don’t forget, you can register for just $349 if you act by March 25th - a savings of $30 per attendee! Starting March 26th, the price will be $379 – so if you know you will be attending our signature event, we strongly encourage you to register now. I am truly looking forward to seeing many of you at the Holiday Inn Rushmore Plaza in Rapid City, SD on May 10 – 11 as we unite to gain insights on all things credit union! Dedicating time for Strategic Planning is critical for your credit union’s future. Your association is always seeking new ways and relationships with service providers to help our Dakota credit unions to remain successful in an ever-changing business environment. That is why we have engaged Jim Kasch and Canidae Consulting as a resource for your strategic planning efforts. Be sure to check out today’s Memo article on this important subject, and don’t hesitate to contact George McDonald to learn more. Supporting Ukraine’s Credit Unions In closing, I’m sure you are all aware of the very serious and dire situation that citizens of Ukraine are facing. Therefore, Leagues around the U.S. have decided to support credit unions in the Ukraine during this horrific time, that in turn will support and serve their members. The Ukrainian Credit Union Displacement Fund will direct support to mitigate both short and long-term impacts to Ukraine's credit union system and those that look to it for support, including employees and members. Worldwide Foundation for Credit Unions (WFCU) in partnership with the World Council (WOCCU), is leveraging their global network to identify the immediate priority areas where funding can be used to support displaced credit union members and staff. If you would like to help, click here to make a donation. Have a great week, and thanks for all you do! DakCU President/CEO

Comments are closed.

|

The MemoThe Memo is DakCU's newsletter that keeps Want the Memo delivered straight to your inbox?

Archives

July 2024

Categories

All

|

|

Copyright Dakota Credit Union Association. All Rights Reserved.

2005 N Kavaney Dr - Suite 201 | Bismarck, North Dakota 58501 Phone: 800-279-6328 | [email protected] | sitemap | privacy policy |