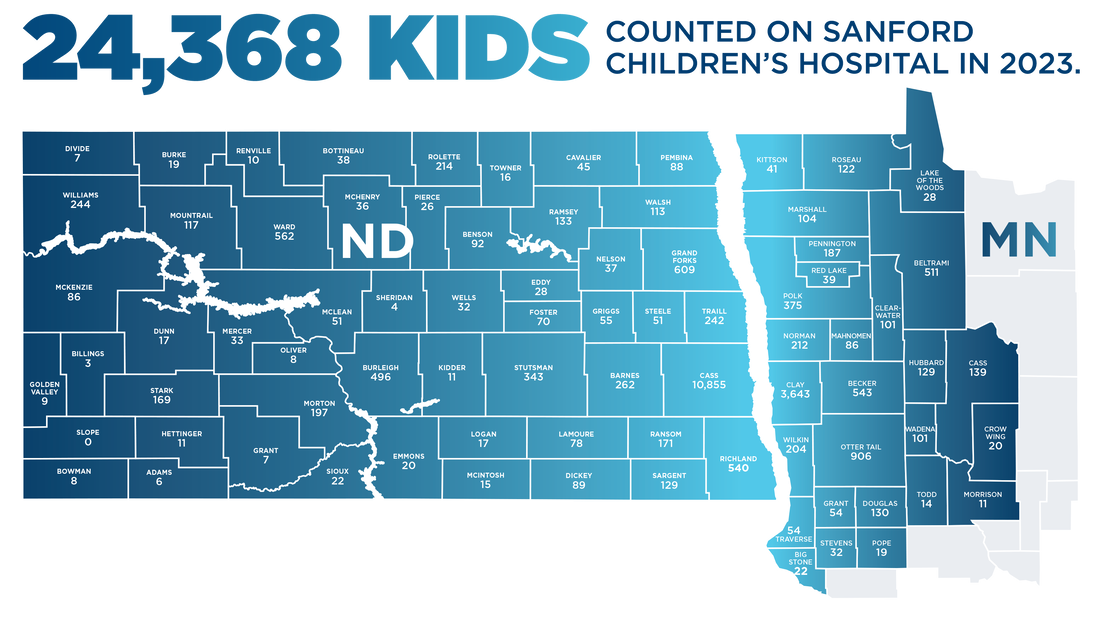

Tanya Otsuka Tanya Otsuka Greetings, Since her swearing in on January 8th, the DakCU advocacy team has been working with the NCUA to schedule an introductory meeting with Director Tanya Otsuka. Today, I am excited to share that Director Otsuka will be our guest on our upcoming CEO Virtual Town Hall, scheduled for Tuesday, April 9th, at 3:00 p.m. CT / 2:00 p.m. MT. Calendar invites have been sent to CEOs via email. If you didn’t receive the meeting invite and link, please let me know, and if you have someone on your team that would like to join in for Director Otsuka’s dialogue, reach out to John Alexander at [email protected] with your request. The Interchange system is under attack. Is it time for a “stop and study?” The proposed changes to debit and credit card interchange being considered by both the Federal Reserve and lawmakers in Congress would do little to help consumers and small businesses and would ultimately line the pockets of the biggest retailers. We have been down this road before. For decades, retailers have turned interchange fees into a scapegoat to distract consumers from what is really behind the curtain: corporate greed. While big box retailers continue spewing false information and myths, we remain committed to fighting this misinformation and protecting the interchange system. With information from both sides cluttering the congressional members’ inboxes, perhaps a “stop and study” would be a good idea. Rep. Blaine Luetkemeyer, R-Mo., introduced a bill to do just that and require the Federal Reserve to study the impacts of its proposal to lower debit interchange fees. Additionally, efforts by retailers and lawmakers to limit credit card interchange fees with the Big Box Bailout bill will hurt financial institutions, consumers, and, yes, even small businesses. The electronic payment system works, and retailers know the power of debit and credit cards, but don’t want to pay their share and pay for the very system that keeps their doors open. Interchange is the cost of doing business, and business builds these costs into their products and services. Plus, many are now adding on electronic payment surcharges and blaming credit and debit card issuers. Now they want to cap interchange fees. Does this mean they are going to lower prices then? Of course not. We know this because retailers failed to pass savings on to consumers when the Durbin interchange bill passed in 2010, cutting interchange fees in half. Limiting interchange fees is a proven failed policy. Credit unions across the Dakotas know all too well the increasing costs of doing business. In fact, it’s these very same regulatory oversteps that are the cause of it. One of Dakota Credit Union Association’s top priorities moving forward is protecting the interchange system from bad proposals in Congress and from the Federal Reserve. Countdown to Summit! It’s hard to believe but are just 49 days away from the Annual Summit, which is rapidly approaching on May 14 – 16 at Grand Falls Casino & Golf Resort just outside of Sioux Falls. I encourage you to register by April 12 and take advantage of the early bird discount. We are confident you will find this year’s event to be an outstanding educational and networking opportunity at a beautiful venue! Please pay close attention to the agenda as we have revised both the schedule and the format a bit, based on feedback we received from previous attendees. Opening session will be held prior to the golf outing; we are offering breakout sessions running concurrently with golf; we have more built-in time for networking; and new training/educational opportunities for credit union board members. I hope to see many of you there! Foundation’s Vacation Sweepstakes Update The Dakota Credit Union Foundation’s Vacation Sweepstakes is off to a great start! One lucky winner will receive a vacation voucher for a destination of their choice worth $5,000! Each $25 donation to the foundation receives one (1) entry; each $100 donation receives five (5) entries! Enter the sweepstakes here. The prize drawing will be held live at the Summit Awards Banquet on May 16. As you know, Foundation Board Chair April Tompkins and I both made personal contributions to establish a separate prize fund, which will help the Foundation to retain more of the proceeds from the sweepstakes. If you and/or your credit union is able to contribute to this special fund, it would help greatly to maximize our charitable impact. You can make a direct prize fund donation here. I want to express my sincere thanks for the generous response we have already received. Finally, we appreciate your assistance in helping to promote this fundraiser, which is open to all residents of North and South Dakota. There is a marketing kit available; please contact Shawn Brummer for assistance. Summit Silent Auction supports Roger Heacock Scholarship fund. Speaking of Summit, once again, the DakCU advocacy team will be hosting a Silent Auction fundraiser, and we are now accepting prize donations. You can make a difference in enhancing and advancing our credit union advocacy! We request that donated items have a minimum value of $75-$100 (or more). You may submit your donation in advance using the easy form found here or contact Chesney Garnos at 701.250.3928 for assistance. Donations will be listed on ClickBid ahead of time. Funds raised from the auction and gift card raffle are used to provide financial assistance scholarships to credit union professionals from North and South Dakota who attend the national Governmental Affairs Conference in Washington, DC, and other meetings, such as our fall “Hike the Hill.” Update on CU4Kids Micro preemie Care Unit Finally, I am happy to share that we are now at $359,100 in pledges with 12 credit unions and the Foundation signing on to support the CU4Kids Micro preemie Care Unit at Sanford Children’s Miracle Network Hospital in Fargo. I would like to emphasize that this is not an “ask” from DakCU; we are merely assisting Sanford in trying to get to the $500K pledge goal in order to have this unit officially named for North Dakota’s credit unions. The Dakota Credit Union Foundation is also supporting this project with both a pledge and time in trying to make this a reality. The bottom line: financial well-being is directly tied to physical and emotional health and well-being. As the only CMN Hospital in the state of North Dakota, Sanford treats patients from every county – every community where our members reside. Below is a map that reflects the number of patients in each county treated in 2023. Thank you to the credit unions that have seen the value of this project. For those who remain uncommitted, please reconsider. As a reminder, you can decide when to begin to fulfill your pledge and how long you need to fulfill it. Every donation is impactful and helps us achieve our goal, and every contributing credit union will have their name on the plaque at the care unit entrance. If you have any questions about this project, contact Shawn Brummer. Thank you for your consideration, DakCU President/CEO

Comments are closed.

|

The MemoThe Memo is DakCU's newsletter that keeps Want the Memo delivered straight to your inbox?

Archives

July 2024

Categories

All

|

|

Copyright Dakota Credit Union Association. All Rights Reserved.

2005 N Kavaney Dr - Suite 201 | Bismarck, North Dakota 58501 Phone: 800-279-6328 | [email protected] | sitemap | privacy policy |