|

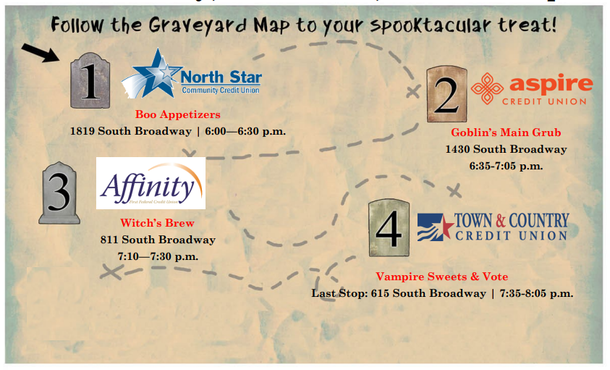

Hometown CU Seeking Loan Officers Hometown Credit Union is seeking a residential loan officer and a commercial loan officer for their Lincoln, ND location. Member-focused, energetic individuals with strong communication skills and solid decision-making abilities are encouraged to apply. Responsibilities include developing lending relationships with members, originating and servicing existing loan portfolios, and taking an active role in the community. A degree in finance, business, accounting, or related field or lending experience is preferred, but not required; willing to train a new residential loan officer. Five years of experience is required for the commercial loan officer position. Salary is negotiable based upon experience. Please submit cover letter and resume to: Hometown Credit Union, PO Box 230, Ashley ND 58413 or email to Abby Wolf, VP of Human Resources at [email protected]. Riverfork FCU Seeking Next CEO Riverfork Federal Credit Union based in Grand Forks, North Dakota, is now seeking its next CEO. With $30 million in assets and nearly 2,200 members, the credit union focuses on its community, members, vision, teamwork, and products to achieve success. Riverfork desires a forward-thinking, community-oriented, service-focused leader to work with an engaged Board of Directors. The selected candidate will be responsible for providing leadership, planning, and oversight of all credit union activities in accordance with policies and objectives established by the Board of Directors. Click here for more information. FREE Webinar: Stand Against Fraud - Trends and Best Practices Traditional identity fraud and resulting losses are increasing. What can your credit union do? Join Envisant for a free webinar on Tuesday, November 14, at 2:00 p.m. (CT) for a look at fraud trends and best practices for your credit union to help guard against it. Register here. North Central Chapter Meeting The North Central Chapter of Credit Unions has scheduled their meeting for Thursday, October 19th at the Sheyenne Senior Center. Meet at 5:30 p.m. for social with dinner served at 6:00 – homemade meatball dinner prepared by the Sheyenne Senior Center community members. A business meeting will follow dinner, and entertainment for the evening will be “Credit Union Jeopardy.” RSVP to Rachel 701-947-5011. Credit Unions United Chapter Halloween Social The Credit Unions United Chapter will hold their progressive Halloween social on Tuesday, October 24 starting at 6:00 p.m. There will be prizes for best group costume, best individual costume, and most creative food. Please RSVP to Jennifer Jerauld. Use your brainy creativity and have some spooky fun! Credit Unions United Chapter Meeting

The Credit Unions United Chapter is hosting a meeting on Tuesday, November 14, at Sleep Inn – 2400 10th St. SW, Minot. Meet at 6:00 p.m. for social with heavy appetizers followed by a self-defense class starting at 6:30 p.m. presented by Spectrum Fitness. To make your credit union reservation, please contact Jennifer Jerauld at Town and Country Credit Union 701-420-6762 or [email protected] no later than Tuesday, November 7th. The charge per person for this event will be $25 which includes food. MonDak Roundtable in Las Vegas. Plan now to join us for the MonDak Roundtable being held January 17-18, 2024 in Las Vegas, Nevada! MonDak is an amazing educational opportunity for senior management, CEOs, and volunteer board members to collaborate and share ideas as they are guided by a professional lineup of top industry thought leaders. This year, we are pleased to include credit union leaders from Minnesota, as well as our friends from Montana, for this high-level educational and networking opportunity. Register by November 22 to take advantage of best pricing and visit the event page for more details. SalesCU Training Due to popular demand, additional dates have been added for SalesCU workshops. SalesCU training offers practical and proven sales techniques and strategies that actually work in a credit union setting to bring affordable and convenient sales training to our Dakota credit unions. If you want to develop employees who know how to sell in a way that adds value to the member, and sales leaders who are empowered to drive results through developmental coaching and meaningful accountability, we have a solution for you! Additional information on upcoming sessions available here or contact George McDonald, Chief Officer of Strategic Services at 701.250.3942. Leadership Development Our iLead@11 DakCU Emerging Leader Program is designed specifically for emerging leaders in the credit union industry, based on the popular Leadership@11 program designed by Eleven Performance Group. It is an ongoing program that allows participants to start whenever they want and determine their own pace. Scholarships are also available through Dakota Credit Union Foundation by completing the application form found here. Help Us Stay Up to Date with Your Staff Please help us to make sure that your employees are receiving the Memo and are in our database for other important information. We strive to bring you the latest important information related to advocacy, compliance, networking and educational opportunities, and more. Is everyone at your credit union receiving this information? Be sure we have the names, title, and email address of any new employees. The more information your staff has, the better for all of us! Email Shawn Brummer to be added to our distribution list or sign up directly here on our website. In the Spotlight Do you know someone at your credit union or another credit union, either employee or volunteer, who has an interesting story? Nominate them for the CU Professionals Spotlight by emailing their name and a brief explanation of why they are “Spotlight” material to Shawn Brummer. Share News Submit your news to Shawn Brummer. Employee promotions, awards, new products or services, community involvement/recognition, job openings, all are welcome! Comments are closed.

|

The MemoThe Memo is DakCU's newsletter that keeps Want the Memo delivered straight to your inbox?

Archives

July 2024

Categories

All

|

|

Copyright Dakota Credit Union Association. All Rights Reserved.

2005 N Kavaney Dr - Suite 201 | Bismarck, North Dakota 58501 Phone: 800-279-6328 | [email protected] | sitemap | privacy policy |