|

by Sean Raboin, partner with HTG Architects

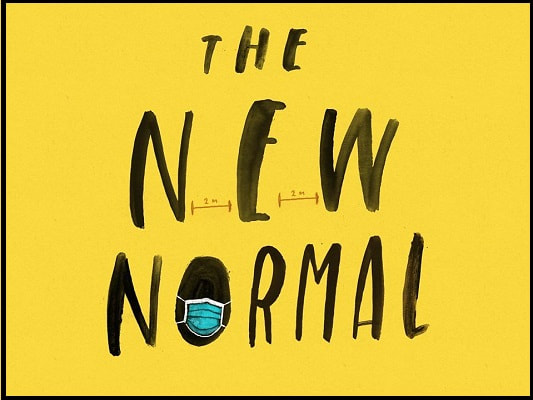

The Unknown The most frequently asked question during conversations with our financial clients today is: what will be the new normal once the pandemic is over? This question is hard to give a specific answer to because the effects from the pandemic are still new and unknown. Because the economic environment is changing daily, it's challenging to know what the best solution is for our financial clients. The Question We all know that new consumer habits will evolve because of the pandemic. Today's million-dollar question is: will the consumer return to retail stores when the pandemic is over? We've already seen a decline in traditional consumer shoppers with the introduction of easy online shopping, thanks to Amazon. So, will the pandemic accelerate the decline of brick-and-mortar stores and have a lasting effect? If yes, will this transition happen immediately or will it take time for this trend to transpire? Our Belief There are many stories in the news of communities starting to gather and ignoring COVID safety guidelines. Families and large groups of people are getting together without masks and with no social distancing. We are social beings; it's in our nature. I am not sure if it is COVID fatigue or simply natural instinct, but people do not like to be cooped up for long periods of time. They want the freedom to go, gather, shop, attend to their financial transactions, and more, when and where they want too. The Advice When the pandemic subsides and the consumer's freedoms return, it will be critical that financial institutions are positioned to service these consumers in the best manner possible. But, what does that mean? We believe there will be new habits to adjust to and plan for, but most people will return to their preferred methods of shopping. One major difference is that the products and services that were important pre-pandemic may not apply any more. So, our advice to our financial clients is this: ask the right questions and be willing and able to adjust to new consumer needs. The level of transformation required of financial providers and the experience they provide is yet to be seen, but those that are already busy planning and trying new things to establish a new, safe, comfortable 'normal' financial institution experience will be most successful. HTG was founded in 1959 by Gene Hickey and began as an architecture firm specializing in financial institution projects. Now, they are known throughout the industry for recreational projects, retail projects, commercial projects, office buildings and industrial buildings. Two types of projects have become their primary niche: financial institutions (banks and credit unions) and recreational buildings (especially ice arenas). They are confident in their ability to meld each client’s vision with their expertise to design and create a facility that works best for them. Visit their website to learn more. Comments are closed.

|

The MemoThe Memo is DakCU's newsletter that keeps Want the Memo delivered straight to your inbox?

Archives

July 2024

Categories

All

|

|

Copyright Dakota Credit Union Association. All Rights Reserved.

2005 N Kavaney Dr - Suite 201 | Bismarck, North Dakota 58501 Phone: 800-279-6328 | [email protected] | sitemap | privacy policy |