|

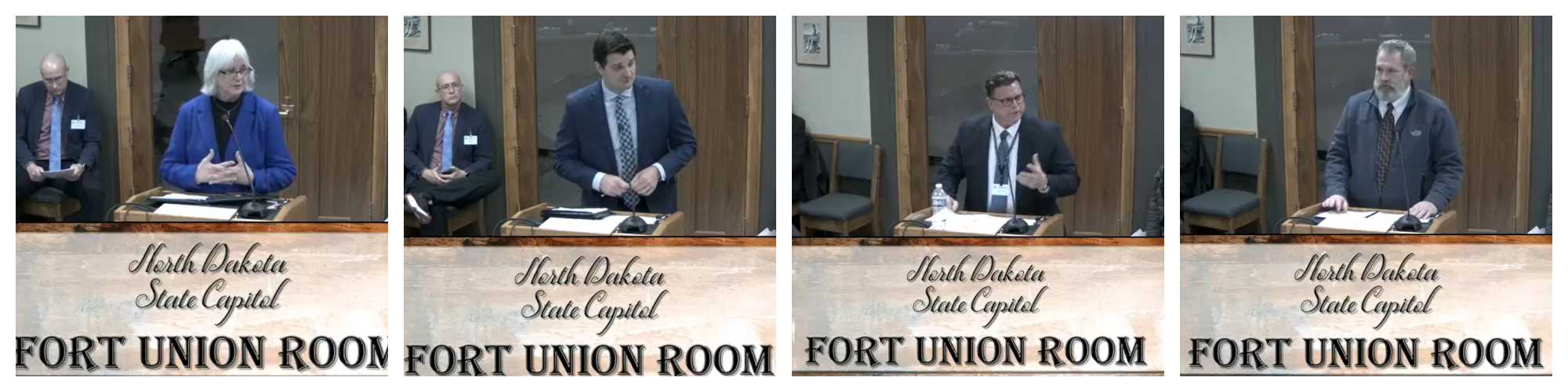

We are still in FULL ACTION ALERT mode in North Dakota after many of our Dakota CU advocates testified in support of our Field of Membership (FOM) modernization bill last week. SB 2266 is expected to come out of the Senate Industry, Business, and Labor Committee this morning, with a Senate Floor vote expected either Wednesday or Thursday! We will know for sure later today, but in the meantime… It is very important that you reach out to your state senators today and ask them to support SB 2266. During testimony last week, North Dakota bankers complained that credit unions have an unfair advantage in the marketplace because of the tax exemption. Nothing new here – just the same old tired argument, even while they continue to dominate the financial landscape in the state. In fact, it’s not even close. At the end of September 2022, North Dakota banks reported $41 billion in assets, compared to $4.7 billion reported by North Dakota’s state chartered credit unions. Regardless of the political rhetoric, we need to remind our legislators of the well-documented economic axiom; “Businesses don’t pay taxes – people do.” Yes, hardworking individual taxpayers pay the true burden of business taxes. If you wish to send our latest tax rebuttal info graph to your state senator, you can download it here or contact Jay Kruse, Shawn Brummer, or me for an emailed copy. We encourage you to use our resources and other legislative action tools on our advocacy web page and especially to use our “Voter Voice” action alert center to reach out to your senator. Please, please engage your staff, volunteers and even your members on this issue. Ultimately, this is about preserving our state charter and protecting financial choice for ALL North Dakotas. It’s credit union leadership time in Vegas as MonDak kicks off today. Today, I am in Las Vegas for the live, in-person MonDak CEO and Volunteer Roundtable meetings. This marks our sixth annual collaborative event, and we are excited to welcome over 100 credit union leaders from the Dakotas, Montana, and New Mexico this year, all are here to participate in two days of high-level learning and networking. We have industry specific pre-conference sessions that are CEO and Volunteer specific, and general sessions led by industry leaders that will challenge attendees to think differently about techniques and trends that can help their credit unions grow and remain relevant with their members. This event should be on your radar in 2024 for events to consider attending. The DakCU Board of Directors is also here using this time to meet in person, and will spend time reviewing and discussing our strategic initiatives for the next few years. Summit registration opening soon. It’s been a full year in the making, and it’s time to mark your calendars for our Annual Summit! This year we are headed to the Delta Marriott in Fargo, ND on May 9 – 10. Registration will officially open next week. Stay tuned to the Memo for further details, and be sure to take advantage of best pricing by signing up early. Med5 rebrands as Aspen Federal Credit Union. Med5 FCU announced in a Facebook video post that they have officially rebranded as Aspen Federal Credit Union. During the next month, you will see new signage at every location and will be hearing their new tagline, “Join the Grove!” Congratulations to Pam Brown-Graff, President, and her entire staff on their new name and image! You can see their video announcement here. Aspen Federal Credit Union staff is excited and ready to serve their members and communities for years to come. Well done! Good news continues for credit unions. Last week, CUNA released their first Auto Lending Report which tells the story of how credit unions provide auto loan interest rates that are far lower (on average) than other auto lenders. We know that access to affordable, reliable transportation is a key component of financial well-being, and as always, credit unions are committed to ensuring consumers have this access. You can read the full report here. Dakota Credit Unions Featured in Business View Magazine Last fall, the Dakota Credit Union Association was asked to contribute to Business View Magazine, a digital platform that covers developments in practically every aspect of business. The request was for a section featuring credit unions and the impact they are having (and have had) on the communities they serve. Always happy to get some “earned media,” staff at DakCU submitted an article for their “Finance & Professional Services” section which focused on how the association is advocating, educating, and leading the way for our valued members. The magazine had also asked for leads on Dakota credit unions that may be interested in participating. Of the many we suggested, Aspire Credit Union (Minot, ND) was chosen for their deep community roots and engagement, as well as their financial successes. Last week, we received the digital edition, which you can find here. The DakCU story begins on page 105 and Aspire Credit Union’s story starts on page 125. Congratulations to Jaymason Bramblee – She’s headed to the GAC! Finally, I want to send a shout out to Jaymason Bramblee from Oahe Federal Credit Union in Pierre, SD. She was selected by Alloya Corporate to receive a full scholarship to the CUNA GAC! This is truly a great accomplishment as the competition is stiff, with decisions made after review by the CMG Memorial Foundation Board. Her award covers registration, lodging, and travel expenses. Congratulations Jaymason, we look forward to seeing you in DC! Have a great week, DakCU President/CEO

Comments are closed.

|

The MemoThe Memo is DakCU's newsletter that keeps Want the Memo delivered straight to your inbox?

Archives

July 2024

Categories

All

|

|

Copyright Dakota Credit Union Association. All Rights Reserved.

2005 N Kavaney Dr - Suite 201 | Bismarck, North Dakota 58501 Phone: 800-279-6328 | [email protected] | sitemap | privacy policy |