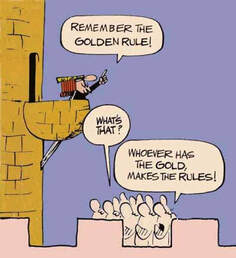

North Dakota credit union Field of Membership (FOM) modernization effort succumbed to the “Golden Rule” – Whoever has the gold makes the rules! Let me clarify. We grew up with a different version of the Golden Rule, one that is the principle of treating others as one wants to be treated, which is quoted in the Bible in Matthew 7:12 and tells us, “do to others whatever you would like them to do to you.” The “new” Golden Rule, which applies here, is attributed to the syndicated comic strip, “The Wizard of ID,” by creators Johnny Hart and Brant Parker, first published in the 1960s in thousands of newspapers. Disney fans may even remember that the character, Jafar, was modeled after it in the animated movie Aladdin years later. While the quote’s original intention was meant to be a humorous form of sarcasm, the irony here is that “whoever has the gold makes the rules” bears some truth in society and cultural hierarchy today. It certainly has a tinge of familiarity in our efforts to modernize the outdated, and backwards, FOM statute in the North Dakota Century Code this legislative session. In case you are not up to speed, our bill, SB 2266, failed on the House Floor by a vote of 39 to 53 last Thursday. “Disappointed” doesn’t begin to describe how I, and many or our credit union advocates, felt after months of planning and educating legislators about credit unions and the need for this statute revision, as well as the benefits that North Dakota consumers would realize. Clearly, the strong-arm and intimidation tactics efforts from the North Dakota banks (and from some lawmakers) worked, and legislators deemed that our credit unions should keep their current limited field of membership restrictions, and like it. It’s been 40 years since North Dakota credit unions have pursued a statute update. That effort in 1983 was successful and produced the ability for state chartered credit unions to accept public deposits – something that has benefited our rural communities ever since. The intent of our SB 2266 bill was to modernize statutory language, giving North Dakota state chartered credit unions similarity with federally chartered credit unions on FOM as well as increased geographic boundaries. More importantly, North Dakotans would have had more financial service options, especially in rural underserved communities. What was really distressing were the comments made by the Industry Business and Labor (IBL) Committee member that presented the bill during the floor consideration and debate. In his comments, he was clearly deceptive in his description of credit unions and what the bill would do, including twisting important data that supported the need to modernize the statute. All one must do is watch the recorded video of the committee hearing before the floor vote took place on March 29, (you can still view it). Within a few minutes of oral testimony, one is able to dispel nearly all the points he shared. For example, the representative failed to mention that credit unions are not-for-profit cooperatives that return their earnings back to their member owners, and that 100 percent of our earnings stay right here in the state. He did share that credit union growth was up 9 percent in North Dakota, but failed to qualify that by sharing that 9 percent was from 2005 to the end of 2022, the 18 years since the current statute passed. And, while he had access to the data, the representative made no mention that credit union growth in our neighboring states over the same time period has left North Dakota far behind. We shared in testimony that comparative growth trends in neighboring states and across the U.S. were three to four times higher. Montana and Minnesota for example, have each grown by 25 percent; Nebraska and South Dakota credit union membership exceeded 33 and 35 percent; and U.S. credit union membership grew over 35 percent over the last 18 years. For us, it is abundantly clear: The restrictive North Dakota FOM statute is the contributing factor to our credit unions falling behind and not keeping pace with the growth trends in our region and across the country. Thus, North Dakota banks have succeeded in curbing credit union membership growth and limiting North Dakotans access to more affordable financial products and services, which is truly unfortunate. While the representative “celebrated” credit union asset growth, he failed to mention that North Dakota banks dominate the state’s marketplace, and it’s not even close. Today, North Dakota banks have 90 percent of the market share in deposits and assets. While he mentioned that credit unions were at $4.7 billion, he made no mention of the fact that North Dakota banks reported $41 billion in assets last year. On the floor, he also stated credit unions assets have grown 84 percent – but that statement wasn’t qualified by a specific time frame, it was simply mentioned as a fact. Again, in testimony, we had shared that credit unions assets did grow 84 percent over the last decade – compared to bank assets growing twice as much at 173 percent. He even shared that there are 121 state credit union branches in the state, but what he failed to mention is that today, there are 428 bank branches in the state – triple the number that credit unions have. All one must do is watch the hearing testimony and compare it to the deceptive statements and bill details that were shared on the house floor to see the bias and misinformation. Unfortunately, in the end, lawmakers chose sides rather than voting on the merits of the bill. Today, North Dakota state chartered credit unions are clearly disadvantaged in comparison to how federally chartered credit unions can operate. If state chartered credit unions converted to federally chartered institutions, an option they always have, they could expand their Field of Membership to include the entire state under the Rural District FOM rule. Our objective with this bill was to preserve the state charter system and maintain local oversight and control. However, our credit unions will need to make strategic decisions moving forward as the NCUA continues to reduce FOM restrictions for federally chartered credit unions. Since 2005, the only way for North Dakota credit unions to expand their geographic area is to merge with another credit union in another community or location and assume their FOM, and that is exactly what has happened, leading to the decline in state charted credit unions in the state. In fact, the total number of credit unions in the state has dropped from 55 to 31, and for state chartered credit unions, the numbers have dropped from 36 to just 18 today. I often think how the average North Dakota citizen must feel about not having access to their preferred financial services provider because they don’t live within a superficially defined geographic area. Personally, I believe that all North Dakota consumers, especially farmers and ranchers in underserved and rural communities, would agree that they should have the freedom to decide who should be their financial services partner. What the legislators did last week allows more growth and profits for banks and fewer options for all North Dakotans who are struggling financially during this time of high inflation and rising interest rates. While this disappointing final vote is a setback and a potential threat to the dual charter system in the state, the Dakota Credit Union Association will be back for the next legislative session with an even stronger message. We would like to thank our bill sponsors and those lawmakers who agreed that North Dakota citizens deserve access to more affordable, local financial services. GAC Silent Auction Donations Needed We are now seeking credit union donations for our GAC Silent Auction. As in past years, we are asking that these items have a minimum retail value of $75 to $100, (or more). To properly promote this fundraiser, we would like to publish the list of prizes ahead of time on our ClickBid interactive site. Please submit your donation in advance using the form found following the link. If you have any issues submitting your donation online, please reach out to Lindsey Hefta at [email protected] or 701-250-3968. The funds raised are used to provide financial assistance scholarships to members from North and South Dakota who attend the CUNA GAC Conference and other meetings, such as “Hike the Hill” events. Since 2008, 83 scholarships have been awarded for a total of $63,500. We thank you in advance! Jay Kruse named CEO of Norstar upon Jane Duerre’s retirement. If you were tuned into the Memo last week, you saw the story about the upcoming retirement of Jane Duerre (Norstar FCU) and Jay Kruse being named the incoming CEO. Jane’s final day will be May 31 and Jay will begin working with her on May 1st prior to her departure. As you know, Jay has been our Chief Advocacy Officer here at the association since 2015. He has been a proven advocacy stalwart for our Dakota credit unions. His experience working in a credit union has been an asset for the association and his engagement has forged even stronger relationships with our federal and state lawmakers. While we will certainly miss Jay’s leadership at DakCU, we are excited that he will continue to serve in the credit union movement here in the Dakotas, and we know he will continue to be a leader moving forward. Please join us in congratulating Jay and wishing him much continued success at Norstar Federal Credit Union. Gerry Singleton Named new CEO of Montana’s Credit Unions In case you haven’t heard the news, the Board of Directors of Montana’s Credit Unions has announced Gerry Singleton as the new President/CEO. Gerry will succeed Tracie Kenyon, who has served in the role for nearly 22 years and has been a valued partner and friend to the Dakota Credit Union Association. Gerry has also been a friend and well-known credit union partner to Dakota credit unions and were looking forward to strengthening our collaborative partnership with Montana’s credit unions. Gerry has served 25 years as the VP of CU System Relations at CUNA Mutual Group, and we are thrilled to have him “next door” in our neighboring state. Have a great week, DakCU President/CEO

Comments are closed.

|

The MemoThe Memo is DakCU's newsletter that keeps Want the Memo delivered straight to your inbox?

Archives

July 2024

Categories

All

|

|

Copyright Dakota Credit Union Association. All Rights Reserved.

2005 N Kavaney Dr - Suite 201 | Bismarck, North Dakota 58501 Phone: 800-279-6328 | [email protected] | sitemap | privacy policy |