|

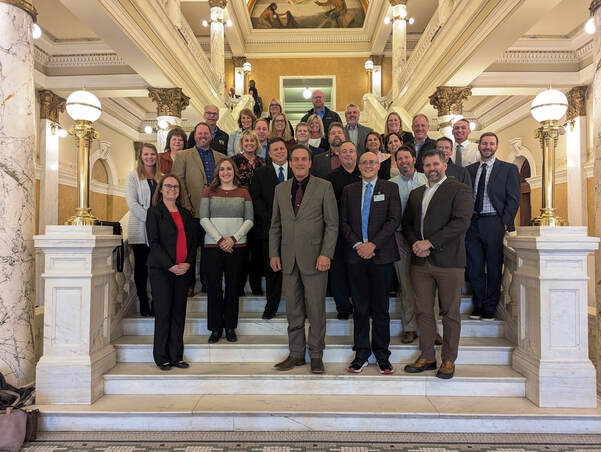

“Team Credit Union” ready to support SB 2266 today at ND State Capitol. The Dakota Credit Union Association, along with representatives from many of our North Dakota credit unions, will be at the State Capitol in front of the Senate Industry Business & Labor (IBL) Committee today at 2:00 p.m. (CT). to testify in support of SB 2266. You can watch the live hearings at ndlegis.gov and then select Fort Union Room. As written, SB 2266 would give North Dakota credit unions similarity with federally chartered credit unions by allowing an individual to join a credit union if they work or attend school in the credit union’s community, in addition to residing. We are also seeking to expand the radius to allow credit unions to serve more rural communities and banking deserts. Today, North Dakota’s 18 state-chartered credit unions operate under one of the strictest Field of Membership (FOM) statutes in the nation, particularly in comparison to how federally chartered credit unions can operate. As written, only those residing within 75 miles of a credit union’s home office, or similar limited radius of a branch, can be a member of an “open charter” state chartered credit union. Because we are primarily a rural state with great distances between our communities, many North Dakotans are being left behind or have limited options for financial services. Why don’t North Dakota credit unions just convert to a federal charter then? That’s a fair question. However, this is about preserving local oversight and control. There are clear advantages to being a state chartered credit union; having the North Dakota Department of Financial Institutions (DFI) as their primary regulator and guidance from the North Dakota State Credit Union Board are the obvious ones. North Dakota’s credit unions and our 214,000 members deserve an operating environment that is fair, modern, and one that helps our state chartered credit unions keep pace with other financial services providers that are expanding into our state. Many of you have already been contacting state senators. Nicholas Dressler, Ag/Business Loan Manager at Western Cooperative Credit Union, said it very well: “As a Credit Union we are a financial cooperative that is owned by the members. Could you imagine if a grain cooperative could not accept grain from a farmer because he lived 51 miles away? Or if ranchers couldn’t sell their cattle here for that reason? As a Credit Union employee, I try to remove myself from the situation and think about how an average citizen would feel, and I still can’t think of any good reason to have these restrictive field of membership requirements. I think any citizen, consumer, farmer, or rancher would agree that they should have access to all financial institutions and the freedom to decide where they conduct business.” With just 10 percent of North Dakota’s market share, our mission in supporting SB 2266 is to improve the financial well-being of our members and advance the communities we serve. If passed, this important legislation will open our state for North Dakota credit unions and protect financial choice for all North Dakotas. Our objective is to preserve our dual charter system in North Dakota and we’re seeking similar FOM powers that federal chartered credit unions have. Please visit our FOM page on our website to learn more. South Dakota credit union advocates rally in Pierre. Over 30 credit union leaders and advocates from a dozen credit unions met in the South Dakota capital city last week for our annual Legislative Day and Social in Pierre. Highlighting Legislative Day was our annual visit to the State Capitol where we had a photo opportunity on the steps with Larry Rhoden, Lieutenant Governor of South Dakota. Attendees were also recognized in both the Senate and House Chambers by lawmakers during the afternoon session. The day culminated with our two-hour casual social, where credit union professionals used the opportunity to visit and share their concerns and current financial service issues with South Dakota lawmakers. This face-to-face time is invaluable to develop and maintain important relationships, in addition to educating lawmakers on our unique structure and purpose. Once again, thank you to everyone who took time to attend this important function. Foundation CUDE Scholarships available now. The Dakota Credit Union Foundation has just approved two $2,000 scholarships, one for North Dakota and one for South Dakota, to attend the National Credit Union Foundation’s Development Education (DE) program. Those who complete the program receive the highly coveted CUDE designation. Cost to attend is $3,699 which includes lodging and most meals; travel expenses are not included. The Foundation scholarship will cover approximately 50 percent of the cost to attend. The first step is to apply for a Foundation Scholarship here using the fillable PDF application. You can find the upcoming DE class schedule here – but I encourage you to move quickly, as the classes are limited in size with only a few seats remaining, according to a recent social media post. Also – get ready for our biggest and best fundraiser ever! This year at the DakCU Summit, we will announce the winner of a vacation package worth $5,000! More details to come on our Vacation Sweepstakes – so stay tuned. Feel free to contact Shawn Brummer with any questions regarding the Dakota Credit Union Foundation. Congratulations to Jennifer Walz, the next President/CEO of Minuteman FCU. First, I would like to extend my congratulations to Mary Connick on her retirement as CEO of Minuteman FCU. Mary has been an involved credit union leader for many years, including serving on the Dakota Credit Union Association Board of Directors. Her last official day at Minuteman is today; so we thank her for her service and wish her all the best. I would also like to say congratulations to Jennifer Walz, who will take over as President/CEO effective February 1st. Jen has years of experience at the credit union, and has embraced each new level of responsibility with a commitment to excellence. On behalf of the Association, we look forward to working with you in your new role! Old credit union documents being sought. “Just a member” blog writer and credit union advocate Chip Filson is asking for assistance from credit unions around the country in his search for records from 1981 – 1985, specifically dealing with deregulation issues that would have been covered in NCUA Watch, Report on Credit Unions, or any records that may have tracked those events. If you have old documents in storage or know of a former credit union leader that may have saved this type of information, please share with Chip at [email protected]. Be sure to read the related Memo story today for more information. Have a great week! DaCU President/CEO

Comments are closed.

|

The MemoThe Memo is DakCU's newsletter that keeps Want the Memo delivered straight to your inbox?

Archives

July 2024

Categories

All

|

|

Copyright Dakota Credit Union Association. All Rights Reserved.

2005 N Kavaney Dr - Suite 201 | Bismarck, North Dakota 58501 Phone: 800-279-6328 | [email protected] | sitemap | privacy policy |