|

Greetings and Happy Monday. Over the past year or so, we have been discussing and sharing a lot about financial health and well-being. Yet, it seems many in our movement don’t know how financial well-being is defined or even measured. The Consumer Financial Protection Bureau defines financial well-being as:

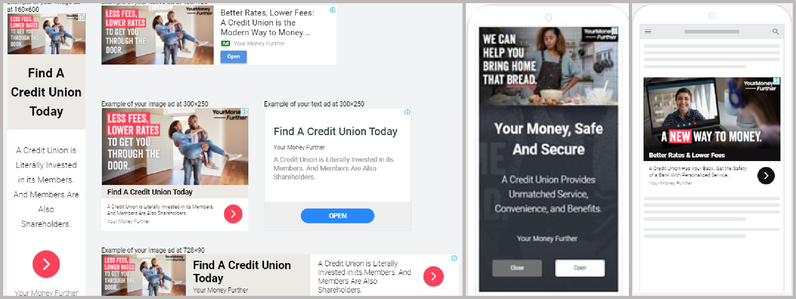

So, financial well-being comes down to the state of a person’s financial situation, their degree of control, and how they feel about their money. Last week I participated in the first of a three-part, three-week National Credit Union Roundtable (NCUR). The NCUR is annual invite-only event sponsored by the Credit Union National Association and brings together leaders from the largest and most influential credit unions across the country to engage in important conversations about our industry's biggest opportunities and most pressing challenges. The focus of our first meeting zeroed in on the concept of financial well-being. Keep in mind that financial health and well-being moves beyond “financial literacy” and “capability” and encompasses the whole state of a person’s financial situation, degree of control, and how they feel about their money. According to the Financial Health Network, 167 million people in America are struggling financially, and financial health disparities have expanded against the backdrop of the pandemic. CUNA President Jim Nussle has stated, “Financial Well-Being for All is the lens through which we exemplify the credit union difference.” It truly is about how we can better serve our members. Credit unions are uniquely positioned to address this challenge due to our core mission, affordable products, and member-centric service model. The credit union movement is rooted in serving the underserved, or “unbanked,” and I see our Dakota credit union leaders prioritizing the financial health of their members every day. By doing so, we strengthen the credit union movement and advance our communities. Our shared commitment is to continue to accelerate the vital work of improving financial well-being for all and advancing the communities we serve. How will you take a leadership role in helping your members and the credit union movement in supporting financial well-being for all? Dakota Credit Union Q-2 CEO Virtual Town Hall Scheduled. We’ve scheduled a virtual Q2 CEO Town Hall for Tuesday, September 22nd at 3:00 p.m. (CT). Please check your email inbox for the invite and virtual meeting link. We hope to have invited guests on the call to provide legislative and regulatory news and updates. We will also use this time to provide details and news on league activities, events, and educational opportunities. If you did not receive the invitation, be sure to let me know. Let’s Do This! Are you ready to make a big social media impact and have a little fun at the same time? Credit Unions across the country are going to unite to make a splash on July 30 with an “I Love My Credit Union” social media blitz. This is the brainchild of our friends at the Illinois Credit Union League, who wanted to do something to inspire nationwide involvement of leagues, credit unions, and members, and connect those conversations with a common hashtag. (Shhhh – we are not supposed to use the hashtag until July 30!) This is so simple to do! Everything you need is just a few clicks away on the resource hub. Here, you can sign up to participate and access everything you’ll need to plan and engage members in this exciting, nationwide collaboration. You’re welcome to personalize the materials with your own branding, design your own content, and add those unique touches that will speak to your membership. To make this even MORE simple, we have arranged for a brief overview and demonstration to show you how fun this is going to be. Join us for a 30-minute (or less) Zoom meeting on Wednesday, June 23rd at 11:30 a.m. (CT). Staff from the Illinois League will be presenting the materials and answer any questions you may have. Click here to register. Q1 “Open Your Eyes” Update I was pleased to see about 20 Dakota credit union professionals participating in our Open Your Eyes awareness campaign update last week. (For a complete recap, be sure to check out the related Memo story today.) I do want to share that the most common question I get from campaign contributors is this: “Why don’t I ever see the Open Your Eyes ads?” Well, the good news is, that means the digital campaign is working as intended. Our paid campaign is designed to target consumers (in launched states like the Dakotas) who are between the ages of 25-55 and who are in the market for financial services. However, if you’re curious, below are some screenshots of what our ads look like “in the wild.” Have a great week! President/CEO

Dakota Credit Union Association Comments are closed.

|

The MemoThe Memo is DakCU's newsletter that keeps Want the Memo delivered straight to your inbox?

Archives

July 2024

Categories

All

|

|

Copyright Dakota Credit Union Association. All Rights Reserved.

2005 N Kavaney Dr - Suite 201 | Bismarck, North Dakota 58501 Phone: 800-279-6328 | [email protected] | sitemap | privacy policy |