|

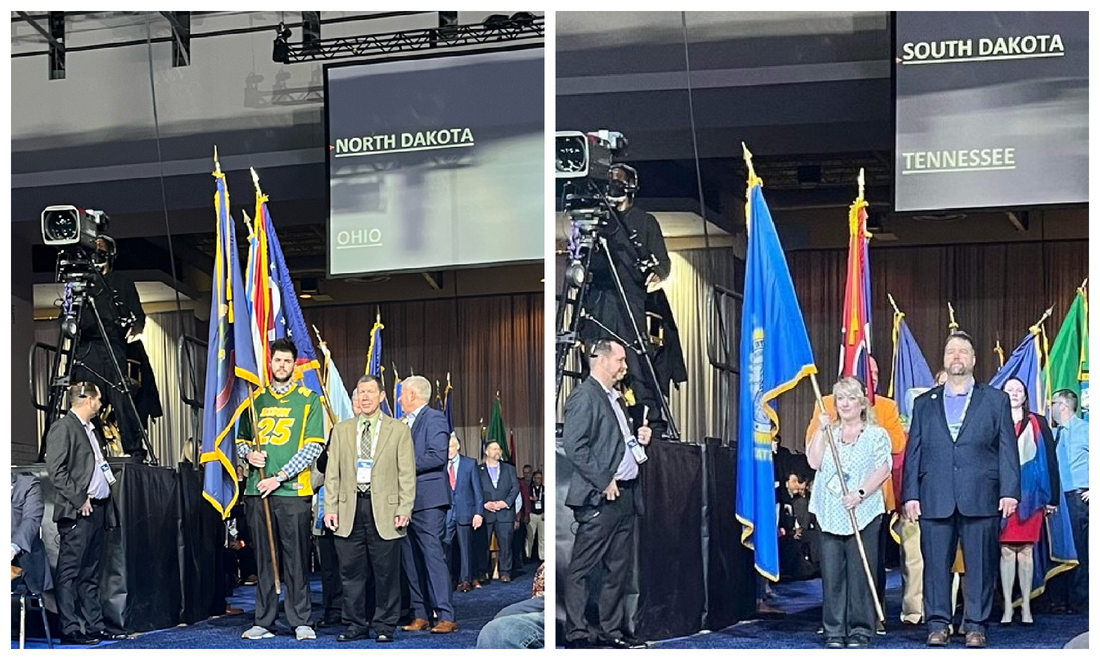

Greetings from our nation’s capital! We’re back in Washington, D.C. for the 2024 Governmental Affairs Conference (GAC). I am very pleased to be joined by 30 Dakota credit union leaders and advocates from a dozen unique credit unions, as well as association advocacy and strategic business solution leaders, to participate in the premier credit union event this year. Several Dakota credit union professionals arrived early and were busy with pre-conference committee meetings and activities over the weekend. We are privileged to have leaders from our region actively engaged on the national level, including Lacey Fetsch, president/CEO of University FCU (Grand Forks, ND), who serves on the Small Credit Union Committee. Chesney Garnos and John Alexander were also busy attending a number of CULAC meetings and training sessions. Personally, by the end of the day on Monday, I had already attended more than a dozen various meetings and receptions! During the annual CULAC Trustees meeting on Sunday, Chad Moller, Dakotaland FCU (Huron, SD), and Paul Brucker, Railway CU (Mandan, ND), were recognized once again with the CULAC Ambassador status for their fundraising efforts this past year. The Ambassadors Program encourages Trustees to increase involvement in fundraising for CULAC in each state; Trustees must meet stiff criteria in certain strategic areas to earn the designation. Congratulations to Chad and Paul, thank you and keep up the great work! This GAC marks the historic launching of America’s Credit Unions, and attendance has set new records with nearly 6,000 advocates gathering from more than 900 credit unions across the United States. Of course, advocacy is always at the forefront of this gathering. By the end of the week, 33 state leagues and associations representing all 50 states and the District of Columbia will have had over 600 meetings with congressional members and officials. Clearly, this is a terrific demonstration of the impressive collaborative power of the credit union system. Following tradition, I was able to meet briefly with our Dakota GAC Crashers just before the opening procession began on Monday, as Noah Trautmann (United Savings CU) and Melissa Cline (Black Hills FCU) proudly represented our two states. I was also honored to appear on the "big stage" with my fellow America’s Credit Unions board members on Monday. It is certainly an exciting time in our industry, with great things ahead! Be sure to stay tuned to our social media platforms (Facebook, X, and LinkedIn) for real time updates as the GAC unfolds and as we discuss policy issues impacting our Dakota credit unions with our Dakota congressional members at our “Hike the Hill” meetings. Bank trade associations send letter to Capitol Hill attacking credit unions. Just as credit union advocates are converging on Capitol Hill this week, the American Bankers Association, and their state affiliates, including both the North and South Dakota Bankers Associations, signed on to a letter to Congress calling for a review and reconsideration of the credit union tax exemption. This action is nothing new; however, it’s evident that the recent unification of our national trade association has made the banking groups a bit nervous. Their letter once again reflects a lack of understanding of the credit union industry and contains numerous false assumptions and baseless claims. Here are the facts and how we responded: Credit union members saw more than $21.5 billion in economic benefits for the 12 months ending September 2023, and non-members received billions more in benefits due to credit unions’ presence in the marketplace, according to America’s Credit Unions’ analysis of NCUA and DataTrac data. We can understand why banks would want to use Congress to eliminate their competition, but this is not in the best interest of hard-working Americans who trust credit unions to provide safe, affordable financial services products. If banks are so concerned about credit unions causing unfair competition, why are they closing branches by the thousands? From 2012-2023, banks closed 19,301 net branches while credit unions opened 1,373 net branches during the same timeframe. It is deeply cynical of banks to write a letter to Congress complaining about credit unions stepping up to serve the consumers they have abandoned. A thank you might be more appropriate. While bankers continue to squeeze every penny of profit out of their customers, they still cannot seem to comprehend that credit unions are tax exempt because of their cooperative not-for-profit structure, which is the core of the credit union industry and reflects credit unions’ commitment to lift up their members and ensure their financial success. Because when credit unions’ members succeed, our credit unions succeed, and the American economy is stronger. It is plain and simple. Much of their letter to members is focused on how credit unions are growing – insinuating that it’s somehow a bad thing. The bankers imply that all credit unions must be small institutions that offer simple products, but that once again belies their ignorance of credit unions’ mission and their fear of competition. Credit unions are adding more comprehensive products because they are meeting the demands of their members, who expect their financial institution to offer innovative, competitive financial services products. Growth is a sign of the success of the credit union charter, not a problem requiring congressional hearings. Quite ironically, the bankers appear to say the quiet part out loud when they cite Federal Reserve Board Member Michelle Bowman’s quote about credit unions competing directly with traditional banks. That competition is exactly what Congress intended and it benefits consumers. Repeated studies have shown that having not-for-profit credit unions competing with banks improves customer service and saves consumers billions of dollars every year in lower fees and better interest rates. Yes, credit unions are growing because consumers are choosing credit unions over banks. Consumers time and again have indicated credit unions have their best interests at heart, and that they trust credit unions more than banks. There is no doubt that credit unions remain consumers’ and Main Street America’s best partner for safe, affordable financial services products. The bottom line: credit unions are growing and innovating, but that is because they are doing the job Congress bestowed upon the industry 90 years ago and consumers are taking advantage of the value credit unions provide them. Celebration planned for Melanie Stillwell. It is always a happy and sad moment when we announce the retirement of a longtime Dakota credit union advocate. Melanie Stillwell, CEO of Western Cooperative Credit Union (Williston, ND) will be handing over the reins to Justin Maddison on April 1st. We are happy for Melanie as we know she will enjoy these coming “golden years,” but at the same time, we know we will miss our friend and staunch credit union supporter. There will be an open house to honor Melanie on Wednesday, March 27, from 1:00 – 4:00 p.m. at the main branch in Williston located at 1300 Bison Drive. The public is welcome, and I hope many of you will join me in wishing her well on this next chapter of her very successful life. Town & Country names interim CEO. Town & Country Credit Union has announced Kalli Schell as interim president/CEO following the resignation of Brad Houle. Kalli has more than 23 years of experience at the credit union, from member service representative to loan servicing, as senior vice president of operations, and most recently as senior executive vice president. TCCU members can be confident that she will provide consistency and steady leadership as the board searches for a permanent president/CEO. Highmark CEO announces upcoming retirement. John Carlson, president/CEO of Highmark Credit Union, has announced his plans to retire on June 30, 2024, after 32 years of service. John began his career at Highmark in June 1992, a “convert” from the banking world. Under his leadership, the credit union has grown from $12 million to over $245 million in assets and more than 13,500 members in the Rapid City area. We thank him for his support of the association over the years and wish him much continued success. Have a great week, DakCU President/CEO

Comments are closed.

|

The MemoThe Memo is DakCU's newsletter that keeps Want the Memo delivered straight to your inbox?

Archives

July 2024

Categories

All

|

|

Copyright Dakota Credit Union Association. All Rights Reserved.

2005 N Kavaney Dr - Suite 201 | Bismarck, North Dakota 58501 Phone: 800-279-6328 | [email protected] | sitemap | privacy policy |