|

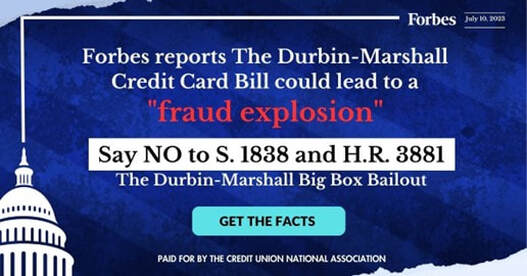

by Chesney Garnos, Director of Political & Grassroots Affairs Before diving into this week’s legislative update, I want to make sure you add travel plans to your 2024 calendar! The DakCU team will host our South Dakota Legislative Day in Pierre on Wednesday, January 24th. The day will be filled with advocacy, fun, and maybe even some karaoke to follow our evening social hour! As always, this event is FREE but we do ask you to register in advance. Sign up for our SD Legislative Day HERE! For other important dates to add to your calendar, you can refer to this link and scroll to the bottom for the details! Headed East Our advocacy team is headed east for meetings in Washington D.C. with CUNA and our North Dakota and South Dakota federal delegations. Advocacy is at the core of who we are as an organization, so these meetings and relationships are crucial to our work at the Dakota Credit Union Association. As I lived in Washington, D.C., for four and a half years, it is always exciting to connect with former colleagues and continue to build on essential relationships. I’ll also hit up my favorite local coffee shop while I’m back in the area to help fuel myself for our busy schedule. If you’re traveling to D.C. anytime soon, please email me for my food and coffee recommendations! America’s Credit Unions Last week, CUNA and NAFCU announced that members have approved the merger of both organizations into America’s Credit Unions. While this vote favoring the merger is no surprise to many, the last few months meant much more than winning votes. The focus was solely an opportunity to learn how credit unions want to be represented and the needs of our credit unions. Moving forward, America’s Credit Unions will officially be legally formed on January 1st, 2024. Then, the building will continue through the year (2024) to combine and create the best services for the merged group. The movement will continue prioritizing advocacy, compliance assistance, educational opportunities, and more! Still have questions about the merger? Check out this FAQ for more information. Interchange Battle Continues Interchange will be on the radar for a while. We are constantly watching in all areas to see if the interchange bills will get attached to other bills. As Congress continues to move forward, this could likely happen for both bills (S. 1838 and H.R. 3881). Supporters will only continue to intensify efforts to add the language to other pieces of legislation as well. Our team at DakCU will work diligently with our federal delegation to advocate for our credit unions and keep our interchange systems the way they are. This is not the only battle we will face, but also the battle of misinformation. Last week, CUNA’s Jason Stverak debunked the misinformation retailers. This included countering incorrect claims about interchange growth and the interchange cost for retailers. To combat this misinformation, you can find an overview and talking points here. You are also welcome to use the following toolkits for your websites, social media, and other outreach efforts – an example of available graphics is shown below. Rural Broadband Grant Opportunity for Credit Unions Rural broadband expansion now allows credit unions to access funds and participate in the Broadband Equity, Access, and Deployment program. Before last week, only banks were allowed to access these funds. This is a $42.5 billion program to expand high-speech internet access nationwide. You can read more on the program here. If you are curious about the funds South Dakota and North Dakota will have access to, you can explore this interactive website by selecting your state. Support Veterans’ Business Lending Credit unions, DakCU, and CUNA continue to support legislation that supports our veterans. Last week, our team encouraged Congress to support legislation to increase credit union lending to veteran-owned businesses. This legislation, known as the Veteran Member Business Loan Act (S. 539), would remove restrictions that cap business lending opportunities for Veterans. Up North in Fargo Last week, our team spent dedicated time at our annual staff planning session in Fargo. With our offices located in Bismark and Sioux Falls, you may be wondering why Fargo. Meeting in Fargo is a halfway point for staff, allowing our team to get a full day of planning sessions with less road time for staff. Our planning meeting is essential as it helps us set goals for the upcoming year and work together as a staff to make important decisions, bring forward new ideas, and improve areas if needed. Since I am in the Sioux Falls office, this also allowed me to connect with our staff on a personal level who do not work out of the Sioux Falls office with me! Final Note: Let’s Celebrate!

Contact Chesney Garnos with any legislative or advocacy questions or concerns. Comments are closed.

|

The MemoThe Memo is DakCU's newsletter that keeps Want the Memo delivered straight to your inbox?

Archives

July 2024

Categories

All

|

|

Copyright Dakota Credit Union Association. All Rights Reserved.

2005 N Kavaney Dr - Suite 201 | Bismarck, North Dakota 58501 Phone: 800-279-6328 | [email protected] | sitemap | privacy policy |