|

by John Alexander, Director of Legislative & Regulatory Affairs DakCU Offers Feedback on Overhead Transfer Rate Methodology The Dakota Credit Union Association (DakCU) recently shared our insights with the National Credit Union Administration (NCUA) regarding the methodology used to calculate the Overhead Transfer Rate (OTR). In our communication, we acknowledged the NCUA's efforts to improve transparency in the OTR methodology, noting the importance of clear explanations for member credit unions. DakCU expressed support for ongoing evaluations of insurance-related allocations for both Federal Credit Unions (FCUs) and State-Chartered Credit Unions (FISCUs), emphasizing fairness and adaptability. The association suggested a triennial review process for assessing the OTR methodology, highlighting its significant impact on NCUA budget formulation and member credit unions. DakCU also appreciated the NCUA's commitment to transparency and stressed the importance of ongoing dialogue to address the sector's changing needs. Read the full letter here. Updates to MDI Preservation Program and Strong Performance of SIF In a unanimous decision on Thursday, the National Credit Union Administration (NCUA) Board greenlit its final interpretive ruling and policy statement, marking a significant overhaul to the Minority Depository Institution (MDI) Preservation Program. The revisions aim to streamline the program's features while providing clarity on the criteria for credit unions to obtain and retain MDI designation, among other modifications. Additionally, the board received a comprehensive briefing on the Share Insurance Fund's (SIF) performance for the quarter ending December 31, 2023. The report unveiled a robust financial picture, with the SIF boasting a net income of $71.7 million, holding $21.4 billion in assets, and accruing $126.2 million in total income. Notably, the equity ratio stood at 1.3% by the end of the fourth quarter. Chairman Todd Harper commended the SIF's sturdy performance, acknowledging the positive strides made. However, he issued a cautionary note, emphasizing the importance of remaining vigilant in overseeing federally insured credit unions. "Though we celebrate the Share Insurance Fund's strong showing in the fourth quarter of 2023, it's imperative to remain alert," stated Chairman Harper. "Recent quarters have witnessed mounting financial pressures on credit union balance sheets and increased consumer financial strain. This underscores the necessity for continued supervision to safeguard the stability of our financial institutions." Indeed, the data presented underscored concerning trends, with a notable uptick in financial stress observed among credit unions, particularly those classified under composite CAMELS codes 3, 4, and 5. In an administrative update, the NCUA Board announced the cancellation of its March meeting, with the subsequent meeting scheduled for April 18. Revocation of Consent Rule Addresses Credit Union Concerns On Thursday, the Federal Communications Commission (FCC) gave the green light to its proposal regarding the revocation of consent under the Telephone Consumer Protection Act (TCPA). The approved rule incorporates several adjustments advocated by America's Credit Unions and its predecessor organizations in discussions with the FCC on the matter. The primary objective of the rule is to bolster consumers' ability to withdraw consent for receiving robocalls and robotexts, addressing concerns raised by credit unions throughout the deliberation process. One notable alteration involves the timeframe for honoring revocation requests. While an initial proposal suggested a strict 24-hour window, the final rule stipulates that robocallers and texters must comply with do not call and consent requests "within a reasonable time from the date that the request is made, not to exceed 10 business days after receipt of the request." Moreover, America's Credit Unions emphasized to the commission that revocation requests should not apply to a broader spectrum of messages than what consumers intend. For instance, consumers may still desire to receive multi-factor authentication texts for accessing their accounts. The rule acknowledged the concerns raised by financial institutions regarding the unintended consequences of consumer revocation requests, particularly the risk of inadvertently opting out of crucial informational calls such as fraud alerts. As a result, the FCC's ruling allows callers to continue reaching consumers with exempted informational calls, which do not necessitate consent, unless and until the consumer explicitly expresses a desire to opt out of these exempted communications. CFPB Updates Appeals Process for Financial Institutions On Friday, the Consumer Financial Protection Bureau (CFPB) unveiled a procedural rule aimed at refining the process through which financial institutions can appeal supervisory findings. This procedural update expands the pool of CFPB officials eligible to assess appeals, diversifies the avenues for resolving appeals, and broadens the scope of matters subject to appeal for institutions seeking to challenge compliance ratings or adverse materials findings. Key modifications introduced in Friday's updated appeals process include:

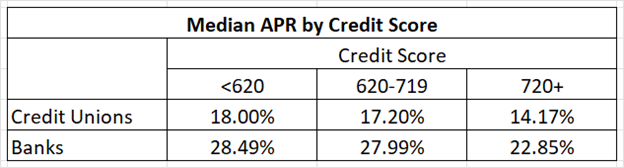

CFPB Data Shows Credit Unions Offer Lower Credit Card Rates. Reprint of original article by America's Credit Unions Credit card survey data shows that credit unions and smaller banks offer lower interest rates than the 25 largest credit card companies, according to a CFPB report released Friday. “The CFPB’s new report on the credit card market clearly shows the credit union difference: Credit unions offer more affordable credit solutions to Americans than the largest issuers,” said America’s Credit Unions President/CEO Jim Nussle. “With better rates and lower annual fees on average, consumers can more easily achieve their best financial lives when they partner with a credit union. This report highlights the importance of allowing credit unions to serve all Americans because big banks clearly aren’t. We will continue to fight for field of membership reforms and other policy improvements to ensure consumers’ access to credit unions and their superior offerings.” The bureau’s findings also showed:

America’s Credit Unions’ data shows credit unions also save consumers with lower credit scores up to $10,000 over the life of a car loan and as much as $50,000 over the life of a home loan. Additionally, the most important differences seen are within minority-majority communities, Black communities, and lower-income communities. These groups are nearly two times more likely to say they are “very positive” that their credit union has positively impacted their finanicial well-being. As always, DakCU members may contact John Alexander with any advocacy or legislative concerns. Comments are closed.

|

The MemoThe Memo is DakCU's newsletter that keeps Want the Memo delivered straight to your inbox?

Archives

July 2024

Categories

All

|

|

Copyright Dakota Credit Union Association. All Rights Reserved.

2005 N Kavaney Dr - Suite 201 | Bismarck, North Dakota 58501 Phone: 800-279-6328 | [email protected] | sitemap | privacy policy |