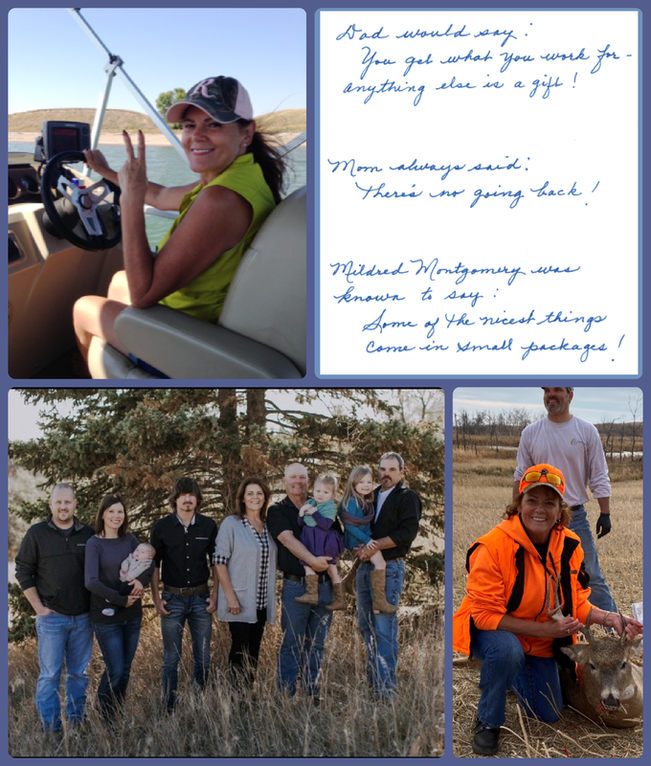

by Shawn Marie Brummer, Communications Specialist Lori (Skarphol) Rivers was the fifth of six children raised on a grain farm north of the small town of McGregor, North Dakota located in the upper northwest corner of the state. Her parents were hard workers, and taught the children proper manners, and respect for elders. Lori says her “hard work” fades in comparison to everything her parents did to provide for the family. While both her parents have passed, she always remembers their very wise words: Her father saying, “You get what you work for – anything else is a gift,” and her mother often repeating, “There’s no going back,” encouraging the children to make good choices and to be responsible for their actions. The McGregor town school closed in 1970, at which time she transferred to the Wildrose Public School, which was in another nearby small town. In her class of nine students there, Lori was the only girl – which had its unique challenges. She says that besides learning the basics, she learned some valuable life lessons during that time that she still uses today, such as humility, endurance, restraint, self-preservation, and empathy. One teacher holds a very fond place her memories; Mildred Montgomery taught third and fourth grades and encouraged good penmanship. To this day, Lori is often complimented on her handwriting, something she attributes to her biweekly cursive lessons. Over the years, she was involved in several different school activities; she worked on the school paper and the annual yearbooks, and participated in sports including cross country running and track. However, since the farm was so far out, winter sports were not encouraged in her family. Following high school, she received her financial and clerical accounting certificate from the University of North Dakota’s Williston Center, and she also studied at the North Dakota School of Banking for a year. Her first job was as the Head Bookkeeper for the Williston Basin State Bank. She worked there for eight years in various positions, including Collections Officer and Consumer Loan Officer. When the bank closed in 1988, she accepted the Manager of Patient Accounts position at Mercy Medical Center in Williston. At the time, they were the largest employer in the area. For the next 16 years, she worked in a department that assisted patients in resolving their cash pay balances while identifying those eligible for financial assistance. As a member of the Meditech team responsible for converting to a new electronic records system, she also worked to establish parameters and guidelines for the accounts receivables system. Despite being selected as Employee of the Month multiple times, the work was becoming increasingly stressful, and she didn’t see herself continuing into retirement. Lori had first joined Western Cooperative Credit Union after the first bank she had been using became insolvent, and the second bank she turned to became too difficult to work with. She contacted the credit union to inquire about their services, and she and her husband became members in 1998. It wasn’t long until she was elected to be a part of the Western Cooperative Credit Union’s Credit Committee, where she served one full term and had just been re-elected for a second, when an employment opportunity opened for her right at the credit union. It was June of 2004 when she was first hired as a loan officer. She continued to expand her skills through various other educational opportunities, including the Dunn & Bradstreet Fundamentals of Credit, and Leadership Resource Training, to name a few. In her role, she serves as a liaison between the member and the credit union, matching the member with appropriate services. She is also responsible to conduct fair and unbiased interviews, evaluating and making decisions regarding various requests while cross selling other services appropriate to the member’s needs. “I love it when I can save a loan for a member from another financial, showing them the savings of doing business with the credit union. I love the fact we can offer lower rates on our loan products in comparison to other financial options, and our management team is always reviewing and revising rates and procedures allowing us to remain competitive,” she expounded. “First and foremost, we put the member first, because without our members we are nothing,” she added. It’s clear that Lori is indeed making a difference at her credit union, and in her community. She was voted “Favorite Loan Officer” in the Williston Herald’s Reader’s Choice Awards in 2015, the first year the contest ran. In addition, she lends her talents to other organizations, including the Miss North Dakota Scholarship Pageant, Junior Achievement, the Upper Missouri Valley Fair Board of Directors, the WCCU Relay for Life team, and Feed the Starving Children, just to name a few. Still, she is humble about the part she plays in the greater picture of community involvement. “I am proud of Western Cooperative Credit Union for its benevolence to the community and its involvement in community affairs. Management and employees are always volunteering their time and services to community projects,” she remarked. In her personal life, Lori has been married to her husband, Shannon, who works for the NDDOT, for almost 43 years. They have two adult children: son Coleman and daughter Lise; one son-in-law, Chris; and four grandchildren ranging in age from 3 to 18 years. Lori and Shannon enjoy hunting together, and have done so for almost 45 years, with Lori herself dressing out most of the deer they harvest. They also enjoy fishing together, and once while fishing for Northern Pike, Lori almost reeled in two snapping turtles at the same time on her two ZEBCO eight-pound lines! One escaped, but the other is now on display in their home. The entire family enjoys spending time outdoors together, camping, boating, fishing, or hunting. Lori also spends time working in her flower beds, watching wildlife, socializing with friends, and organizing practically anything and everything – all activities she plans to enjoy more starting July 30th, her official retirement day. In closing, Melanie Stillwell, CEO of Western Cooperative CU had this to say: “Lori has been a big contributor to our lending department and the entire credit union during her years at WCCU. Her impact went beyond lending to the many activities she volunteered for as a representative of the credit union. She developed a very strong rapport with so many of our members, and I know they will miss her. Our staff will certainly miss Lori (and her engaging laugh). Congratulations and thank you for all you have done over the past 17 years!” Comments are closed.

|

The MemoThe Memo is DakCU's newsletter that keeps Want the Memo delivered straight to your inbox?

Archives

July 2024

Categories

All

|

|

Copyright Dakota Credit Union Association. All Rights Reserved.

2005 N Kavaney Dr - Suite 201 | Bismarck, North Dakota 58501 Phone: 800-279-6328 | [email protected] | sitemap | privacy policy |