|

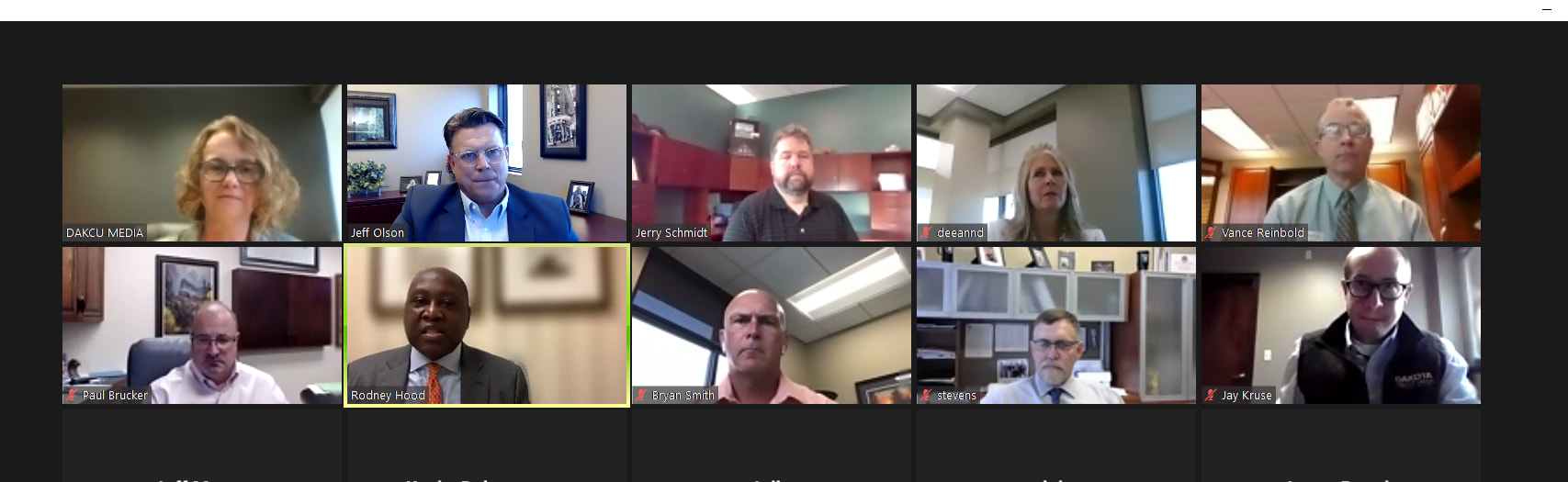

by Amy Kleinschmit, Chief Compliance Officer Regulatory Hike the Hill On Tuesday and Wednesday of this week, credit union professionals from across the Dakotas heard from representatives of the Consumer Financial Protection Bureau and the National Credit Union Administration Board. Things kicked off virtually Tuesday morning with over 30 credit union professionals representing 18 unique Dakota credit unions hearing from the NCUA Chairman Todd Harper. The Chairman provided an update and urged credit unions to continue working with their members. Harper noted that credit unions continue to stay strong but face a difficult environment in months ahead; as programs end, households will experience financial distress, particularly low income. He explained that examiners have been instructed not to criticize credit unions that have taken steps to help their members through the pandemic as long as it was done prudently. The Chairman expressed concerns regarding surrounding compliance with fair lending rules, Truth in Lending and electronic fund transfer regulations, mentioning the need for a dedicated program to monitor for compliance within the NCUA. Finally, he concluded his opening remarks with the need to ensure economic equity and justice for all. Attendees had submitted questions in advance of the meeting which were addressed by the Chairman through a dialogue led by Jeff Olson, DakCU CEO/President, and me, Amy Kleinschmit. With regard to future rulemaking, the Chairman hopes to have the CAMELS rule finalized (adding ‘S’ to the CAMEL score) and finalize rulemaking for the Complex Credit Union Leverage Ratio. Reminder: Comments are due October 15. The Chairman also spoke on the importance of succession planning so that a merger does not have to be the only option when senior management retires. There are also plans, through interagency rulemaking, to address automated valuation models with quality control checks. During our meeting the Consumer Financial Protection Bureau, attendees received information from a variety of CFPB representatives regarding regulatory implementation material to assist credit unions with reviewing proposed rules and implementing new rules. These plain language resources can be found here. The CFPB is asking credit unions to boost awareness of options for renters and landlords struggling during the pandemic, including the Emergency Rental Assistance program. These resources can be found here and include a tool to find help with rental assistance programs based on state and/or tribe location. Attendees also received an overview of CFPB proposed rulemaking concerning Section 1071 Small Business Lending, as was previously discussed in this prior Memo article. NCUA Vice Chairman Kyle Hauptman thanked credit unions for adapting so quickly to the demands of COVID and shared his priories with the Dakota credit union professionals, which include de novo credit unions and keeping small credit unions alive. He stressed the need for feedback and transparency, including encouraging credit unions to record the examination exit meeting (notice needs to be provided to the examiner and applies to NCUA exams only) and finally, shared his thoughts for crypto and blockchain. There was a lot of dialogue on virtual versus in-person exams as credit union participants provided feedback, both positive and otherwise, regarding their recent examination experiences. The Vice Chairman touched on a post-examination survey pilot program, pointing out that quality control surveys are very commonplace in our lives today, and it seems logical to be used in this context as well. Be sure to review Letter to Federal Credit Union 21-FCU-05 that was issued earlier this week to learn more about this pilot program which will run September 20, 2021 to March 31, 2022. The virtual Regulatory Hike the Hill event wrapped up with a great conversation between NCUA Board Member Rodney Hood and the Dakota credit unions. Director Hood stressed the importance of personal engagement and the importance of credit unions telling their stories. He touched on a number of topics that generated good conversation from the attendees, from financial innovation thru fintech’s, including appraisal possibilities, to stressing the importance of business lending. Director Hood also stressed the need for financial inclusion and urged attendees to look at this concept broadly and to include rural populations and disabled individuals. We thank all Dakota attendees and representatives from the NCUA and CFPB for their time and willingness to engage this opportunity for open dialogue. Remember, the Dakota Credit Union Association regularly schedules Hike the Hill events in September and we hope to return to an in-person event soon – so be sure to mark your calendars for next year’s hike.

Comments are closed.

|

The MemoThe Memo is DakCU's newsletter that keeps Want the Memo delivered straight to your inbox?

Archives

July 2024

Categories

All

|

|

Copyright Dakota Credit Union Association. All Rights Reserved.

2005 N Kavaney Dr - Suite 201 | Bismarck, North Dakota 58501 Phone: 800-279-6328 | [email protected] | sitemap | privacy policy |