|

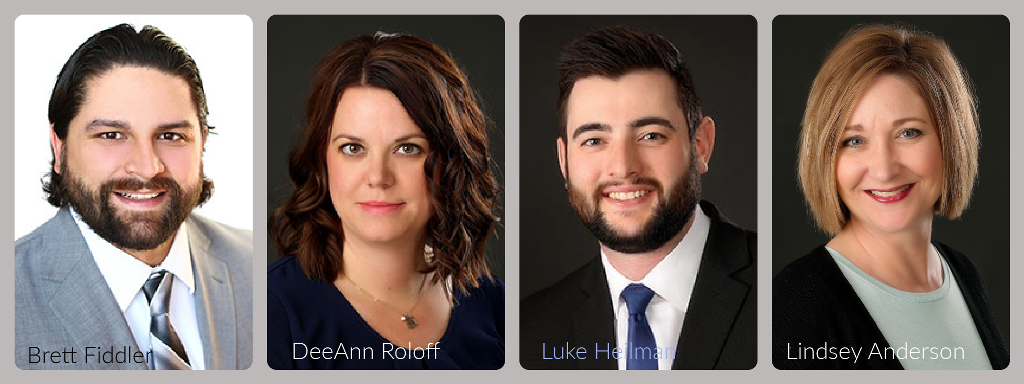

Hometown CU Employees Volunteer at Local School Hometown Credit Union employees recently volunteered at the “Living on My Own” reality simulation at Kulm Public School. This simulation through the NDSU Extension Services teaches the senior classes of Kulm and Edgeley about the importance of budgeting for major expenses, such as purchasing a home or car, and paying bills. The students also learn everyday life tasks such as doing laundry. The staff of Hometown Credit Union enjoys helping students learn life skills, as well as getting to know the local students and learning about their future goals! Additionally, two of Hometown’s Kulm branch Ag loan officers, John & Layton, had the privilege to talk with the Consumer Education class about the importance of learning how to read and complete a balance sheet - especially if the students are planning to run a business, including a farm, someday. They also discussed how to figure net worth and how to build credit, as well as why it may be important to attend a trade school/college to learn skills they can bring back to their business to save on costs. Johnson Recognized by Minnesota Housing Peter Johnson, Executive Mortgage Officer at Town & Country Credit Union in Fargo, was named a Top Producing Loan Officer by Minnesota Housing for his Single Family homeownership program loan production volume during 2020. Minnesota Housing supports and strengthens homeownership by working with local loan officers like Peter to provide affordable homebuyer loans. The Minnesota Housing Top Producing Loan Officer Program has been recognizing individual loan officers with the highest volume of Minnesota Housing program loans for over a decade. Loan officers from the participating lender network who meet regional production volume thresholds are recognized at one of three levels: Platinum, Gold and Silver. Peter earned a Platinum designation. “At Town & Country Credit Union, we’re on a mission to Positively Impact those we serve.” Said Jeremiah Kossen, President/CEO. “Partnering with Minnesota Housing and other financing programs allows us to offer great programs that help members make the dream of home ownership a reality.” Staff Announcements from Town & Country CU Town & Country Credit Union of Minot, ND is pleased to make several formal staff announcements. Brett Fiddler was promoted to Mortgage Loan Officer. A Minot native, Fiddler graduated from Minot State University with degrees in finance and international business and brings six years of credit union lending experience to his new role. Most recently, he assisted Town & Country members as a commercial loan officer. In his new position, he will join the Town & Country mortgage team providing Minot-area borrowers with local mortgage lending services including purchases, refinances and first-time homebuyer programs. Fiddler also currently serves as the president of Sunrise Rotary and the treasurer for the API Bakken Chapter. DeeAnn Roloff was promoted to Plastics Assistant. A Wyoming native, she brings 16 years of experience in financial institutions including four years focused on plastics and disputes to her new role. Roloff joined Town & Country Credit Union in 2020 and most recently served as a Member Services Associate. In her new role, she will be responsible for assisting in the management of the credit union’s debit and credit card portfolio, including helping members with card-related issues and processing card disputes. Luke Heilman recently joined Town & Country Credit Union as a Commercial Loan Officer. A Minot native, Heilman brings over five years of banking experience with a focus on member service and credit to this new role. He also holds a degree in finance from Minot State University. As a commercial loan officer, Heilman will be helping business members achieve their goals by leveraging the credit union’s lending products. In his spare time, he serves on the board for the Minot Y’s Men. Lindsey Anderson, Director of Internal Audit at Town & Country Credit Union, earned her Certified Credit Union Internal Auditor (CCUIA) designation this month. This designation signifies expert understanding of credit union internal auditing. In order to receive that designation, Anderson was required to complete the CUNA & ACUIA Internal Audit Certification virtual school program and pass an exam. Anderson joined Town & Country Credit Union in 2020. She holds a degree in finance from the University of North Dakota and has over six years of internal audit experience in both community banks and credit unions. 1st Liberty FCU Seeking Branch Supervisor

1st Liberty FCU is seeking a Branch Supervisor for their Grand Forks Downtown Branch. This position will supervise and direct the operations of a small branch for a full-service credit union. Duties include overseeing operational, accounting, marketing and loan processes, responsible for loan underwriting and lending decisions, building deposits and loan relationships, promoting sales of products/services; and retaining and building relationships with members. Will also recruit, hire, train, coach, mentor and supervise support staff, and monitor facility and equipment needs. Prefer business degree or equivalent in business, finance, economics or a related field from an accredited college or university, and two years of leadership and managerial experience. To apply, please submit resume to Jamie Jacobs, H.R. Director, 1st Liberty Federal Credit Union, P.O. Box 5002, Great Falls, MT 59403 or email to [email protected]. Maurie C. Byrne Chapter Meeting The Maurie C. Byrne Chapter Meeting is scheduled for Tuesday, May 18, hosted by Area Community Credit Union. Meet at the Eagles Club – 227 10th Street NW – East Grand Forks, MN at 6:00 p.m. for Social, followed by Dinner Buffet (Roast Turkey, Baked Ham, Mashed Potatoes and Gravy, Corn and Lettuce Salad - $28.75 per person) and meeting to follow. Program will be Robbery Preparedness Training by the East Grand Forks Police Department. Kindly RSVP to Lonny Nygren. Help Us Stay Up to Date with Your Staff! Please help us to make sure that your employees are receiving the Memo and are in our database for other important information. We strive to bring you the latest important information related to advocacy, compliance, networking and educational opportunities, and more. Is everyone at your credit union receiving this information? Be sure we have the names, title, and email address of any new employees. The more information your staff has, the better for all of us! Email Shawn Brummer to be added to our distribution list or sign up directly here on our website. In the Spotlight Do you know someone at your credit union or another credit union, either employee or volunteer, who has an interesting story? Nominate them for the CU Professionals Spotlight by emailing their name and a brief explanation of why they are “Spotlight” material to Shawn Brummer. Share News Submit your news to Shawn Brummer. Employee promotions, awards, new products or services, community involvement/recognition, job openings, all are welcome! Comments are closed.

|

The MemoThe Memo is DakCU's newsletter that keeps Want the Memo delivered straight to your inbox?

Archives

July 2024

Categories

All

|

|

Copyright Dakota Credit Union Association. All Rights Reserved.

2005 N Kavaney Dr - Suite 201 | Bismarck, North Dakota 58501 Phone: 800-279-6328 | [email protected] | sitemap | privacy policy |