|

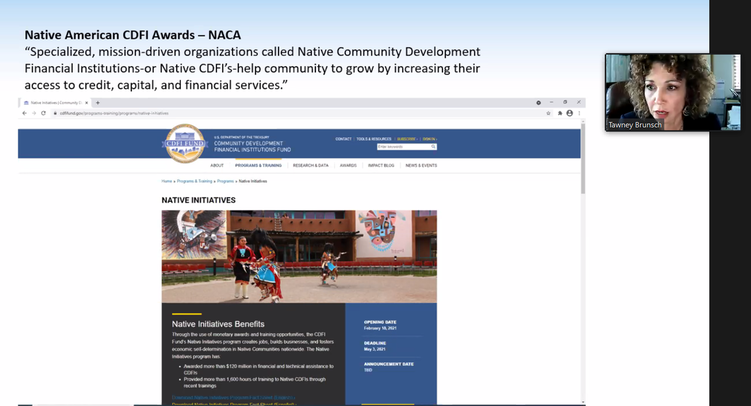

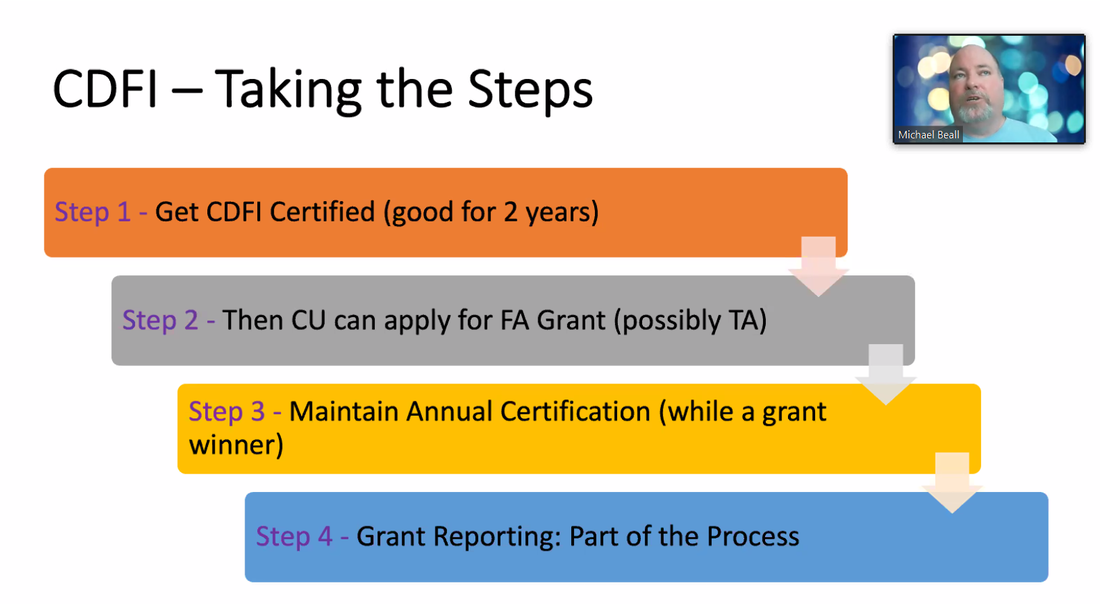

Since August of 2020, CUNA has been hosting a series of Small Credit Union Webinars each Tuesday. In this collaborative effort, CUNA and nearly every state League has been presenting important topics specifically designed for small credit unions. This week, on Tuesday, April 6th, it was our turn! Dakota Credit Union Association (DakCU) hosted a very important informational session titled “How grants can benefit your credit union, your members, and your community.” Amy Kleinschmit, Chief Compliance Officer, opened the session by welcoming more than 220 attendees and introduced our guests: Tawney Brunsch and Mike Beall. Tawney is the Executive Director of Lakota Funds, the first Native Community Development Financial Institution (CDFI) on a reservation. She has led this financial institution through several history-making accomplishments, including: the charter of the Lakota Federal Credit Union, where she is the chairwoman; the launch of a child development account program; and the conversion of a low-income tax credit housing development into privately owned homes. She explained that Lakota FCU’s mission, briefly, is to provide quality financial services located at home on the Pine Ridge Reservation so the people can save, plan, and provide for their futures. Chartered by NCUA in 2012, in nine years they have grown to more than 3,000 members, with loans totaling $2.4M and assets over $8.5M. In addition, they now offer checking accounts, remote deposit, an online banking app, home mortgage loans and credit cards. It all began with Lakota Funds and their CDFI designation. Starting the credit union would never have happened without the Native American CDFI Assistance (NACA). The first NACA grant allowed Lakota Funds to hire a full-time person to begin working on the charter process for Lakota FCU as well as education and outreach in the community about the benefits of having a local credit union. Grants have covered approximately 70 percent of Lakota FCU’s budget; since 2013 they have received $5.4M that has been used to support products and services. In closing, Tawney reviewed some best practices for getting started with grants which included: Choosing an accounting firm familiar with credit unions and grant accounting; Allowing for time to complete application as well as required reporting and compliance; Keeping board and staff informed of grant benchmarks; Utilizing the grant in conjunction with strategic planning; and Regular communication with regulators. Next up was Mike Beall, who specializes in credit union strategic planning and grant writing. He is recognized as an international credit union leader, advocate, and innovator. Mike joined CU Strategic Planning in 2014; however, his involvement with this organization started in 2010 when he was President/CEO of the Missouri Credit Union Association and partnered with CU Strategic Planning to create Community Development Across Missouri. The project was the first mass certification of credit unions as CDFIs and garnered the greatest number of CDFI grants awarded to a single state in one funding round, which stands to this date. Mike began by complimenting Tawney on all that she has achieved in her community. His first advice to attendees: GET CDFI CERTIFIED! The process takes a minimum of three months, but realistically you should expect approximately five months. Credit unions do not necessarily need to be Low Income Designated by NCUA to become CDFI certified, but the reality is getting CDFI certified is much easier with LID certification. (Think of it like a “TSA Pre-Check.”) He also encouraged credit unions to speak to their NCUA examiner, who will likely be able to help receive the CDFI certification. In addition, he provided an overview of the various CDFI Programs currently underway, as well as several that are opening soon. While applying can be a significant amount of work, the rewards are quite often worth the time. If you are already certified CDFI, it is time to get started for 2022 submissions. And, if you are not certified, CU Strategic Planning can help you build a roadmap. If you are interested in learning more about how CU Strategic Planning can help you, be sure to contact mike at [email protected]. As a reminder, there are three sessions remaining in the Small Credit Union series, one on each of the next three Tuesdays. If you are interested in joining, you can still register here. Once registered, you can also review previously recorded sessions. Comments are closed.

|

The MemoThe Memo is DakCU's newsletter that keeps Want the Memo delivered straight to your inbox?

Archives

July 2024

Categories

All

|

|

Copyright Dakota Credit Union Association. All Rights Reserved.

2005 N Kavaney Dr - Suite 201 | Bismarck, North Dakota 58501 Phone: 800-279-6328 | [email protected] | sitemap | privacy policy |