|

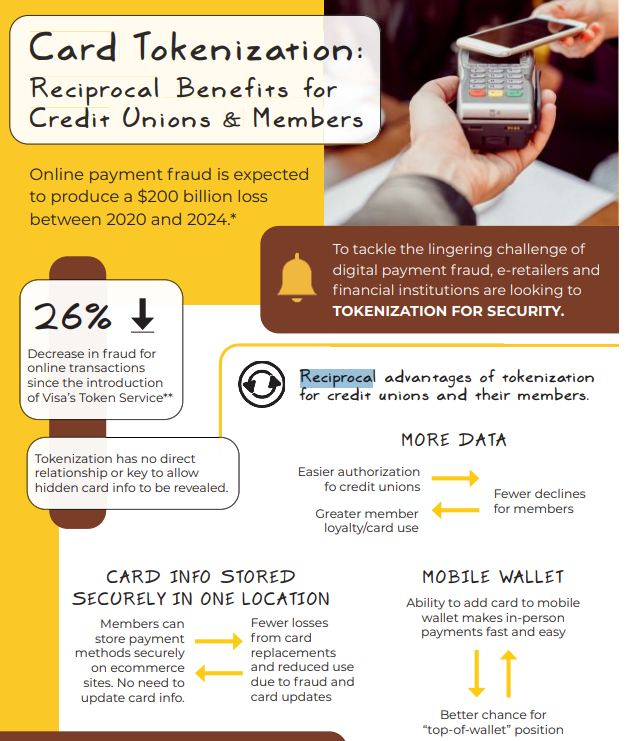

In 2021, 82% of American consumers shopped using digital payment methods (McKinsey & Company). That’s a ten percent increase in five years! No doubt about it, America has gone digital. We’ve come to expect deliveries to arrive within hours and access to information in the blink of an eye. When a member requests a card it’s no different. They don’t want to wait for a card in the mail. They expect immediate access and a seamless shopping experience. For members who want this convenience along with total control of their budget, prepaid cards with tokenization and digital issuance are the solution. What Are Virtual Prepaid Cards? A virtual prepaid card has a 16-digit number and requires activation like a physical card, but issuing the virtual “card” is both faster and more cost-effective. The issuer sends the purchased virtual “card” to the provided email address immediately. Virtual Issuance and Tokenization – An Awesome Digital Team Virtual prepaid cards are mostly for online use or purchases made over the phone. They aren’t generally usable for in-store purchases or at ATMs. That is where tokenization steps in to create that seamless prepaid card experience. Members can add tokenized prepaid virtual cards to their mobile wallets and swipe their mobile devices at checkout. Tokenization also protects against fraud. A random number, or token, replaces the cardholder’s personal information during checkout. The token has no direct relationship with the card number so hackers can’t access it. When virtual issuance combines with tokenization, members get the convenience of a fully digital experience from start to finish. They get instant access to the budgeting convenience of prepaid cards that can be used both online and in-person without having to keep track of a physical card. To learn how Envisant can help with your digital payment strategy, contact us at 1-800-942-7124. At Envisant, our mission is to help credit unions compete and to provide credit unions with a favorable operating environment and quality information, products and services, which have value, and which enable credit unions to exist, compete and prosper in the financial marketplace. Visit our website to learn more. Envisant is a DakCU Senior CAP preferred partner. Contact Jennifer Barret at 224.760.0768 or George McDonald, DakCU's Chief Officer of Strategic Services with any questions.

Comments are closed.

|

The MemoThe Memo is DakCU's newsletter that keeps Want the Memo delivered straight to your inbox?

Archives

April 2024

Categories

All

|

|

Copyright Dakota Credit Union Association. All Rights Reserved.

2005 N Kavaney Dr - Suite 201 | Bismarck, North Dakota 58501 Phone: 800-279-6328 | info@dakcu.org | sitemap | privacy policy |